11.21.2025

Sausage casings bulletin, November 21, 2025

...

The US hide market closed the week trading slightly lower than the previous with a number of steer hide prices under pressure. However, cow hides are in demand due to the firm furniture upholstery business. Native Bulls, a common selection used for leather furniture, have traded up $3 today from the prior trading day. Branded Bulls have traded up $2 today from the prior trading day. The week ends with continued shipping and container availability concerns.

Week-Ending Slaughter

The week’s estimated cattle slaughter was 657,000. The previous week’s kill was 651,000 and the corresponding week last year it was 644,000. Year-to-date slaughter at 2.028 million is down 9.8% from 2018.

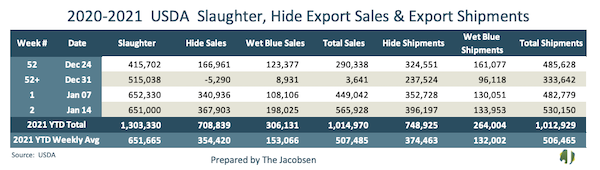

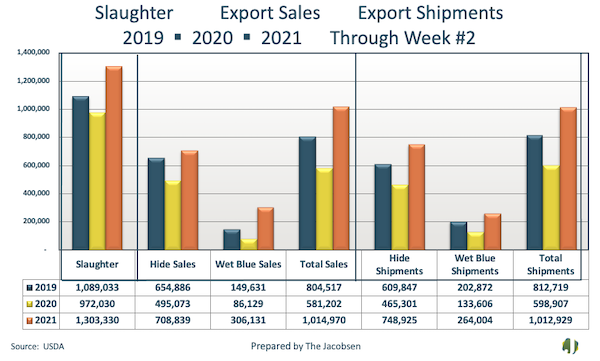

USDA Cured Hide and Wet Blue Export Sales Recap

For week ending January 14, export sales for 2021 marketing year increased 26 percent to 449,042 from 565,928 and shipments increased 10 percent to 482,779 from 530,150. Sales for marketing year 2021 totaled 1,014,970—mostly all hides. The average year-to-date weekly trends for federally inspected slaughter were 651,665, total export sales were 507,485 and total export shipments were 506,465.

USDA Hides and Skins Report

Net sales of 367,900 pieces for 2021, primarily for China (232,200 whole cattle hides, including decreases of 16,200 pieces), South Korea (71,500 whole cattle hides, including decreases of 6,300 pieces), Mexico (33,000 whole cattle hides, including decreases of 6,400 pieces), Brazil (15,600 whole cattle hides), and Thailand (7,600 whole cattle hides, including decreases of 800 pieces), were offset by reductions for Japan (200 pieces). Exports of 396,200 pieces for 2021 were primarily to China (245,800 pieces), South Korea (79,500 pieces), Mexico (38,400 pieces), Taiwan (14,100 pieces), and Thailand (11,100 pieces).

Net sales of 198,000 wet blues for 2021, primarily for China (96,800 unsplit), Vietnam (85,700 unsplit, including decreases of 700 unsplit), Italy (7,400 unsplit and 200 grain splits, including decreases of 200 unsplit), Mexico (4,500 grain splits and 1,700 unsplit), and Taiwan (1,800 unsplit), were offset by reductions primarily for Thailand (200 unsplit). Exports of 134,000 wet blues for 2021 were primarily to Vietnam (44,400 unsplit and 1,900 grain splits), China (33,900 unsplit), Italy (11,100 unsplit and 8,100 grain splits), Thailand (14,700 unsplit), and Brazil (6,800 unsplit). Net sales of splits, 361,200 pounds for 2021, were reported for China (354,300 pounds) and Vietnam (6,900 pounds, including decreases of 400 pounds). Total exports of 323,300 pounds were to Vietnam.

Link to Complete USDA Report: EXPORT-SALES/HIDESFAX

HNS 60 MIN @ $41.00 OR 0.5325

HNS 62/64 @ $39.00 OR 0.4825

BS 62/64 @ $27.00

BS 70 MIN @ $28.00

CBS 68 MIN @ $25.00 OR 0.2875

N Bull 105/115 @ $16.00 OR 0.1450

B Bull 105/110 @ $13.00 OR 0.1225

HNS 62/64 @ $31.50 OR 0.3900

BS 62/64 @ $23.50

CBS 66/68 @ $19.00 OR 0.2200

N Bull 105/115 @ $10.00 OR 0.0900

B Bull 105/115 @ $9.00 OR 0.0825

Brazil

Slaughter remains running at a low pace.

Fresh raw hides are quoting upwards at Reales$1.58 per kg.

Good quality heavy wet blue heavy hides TR1 from Mato Grosso are also upwards from the last weeks, at about US$0.90~1.00 per sq.ft.

Demand is getting firmer

**Visit our International Hide & Leather Bulletin to see market news for additional countries across globe.**