11.21.2025

Sausage casings bulletin, November 21, 2025

...

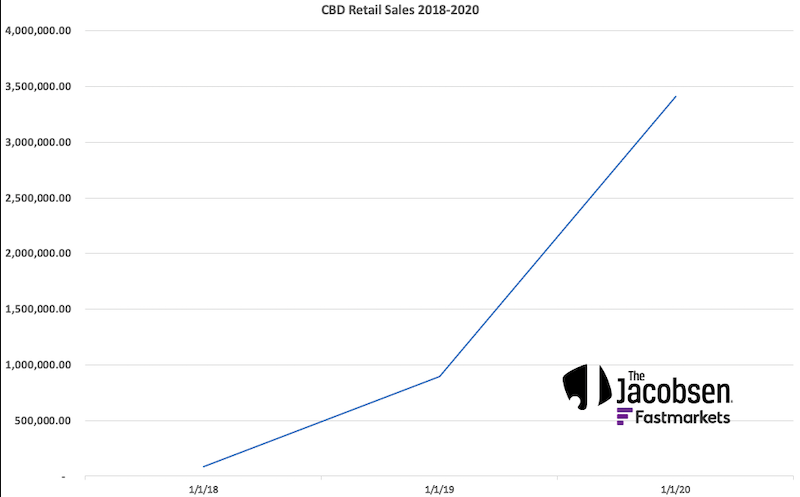

Market projections for CBD have stated that the current market is anywhere from $2-4 billion globally, and expected to grow at double digit CAGR. Early projections by firms showed that markets could exceed $20 billion by 2024, but in 2020 these were adjusted downward. Nevertheless, the outlook remains bullish with estimates from roughly $8 billion to $20 billion in 2026. Hemp prices will not increase commensurately, but increased sales volume will help to shore up markets and stabilize hemp pricing.

The optimism is not unrealistic in some respects, looking at global market potential, and including sales of pet products and cosmetics, two of the expected growth areas. Nielsen is an historical data aggregator that has been collecting retail sales figures for CBD since at least December 2017. Nielsen by no means captures all of the CBD sales in the US. Sales channels are extremely diverse, ranging from chiropractors to yoga studios and golf pro shops. Brick and mortar specialty shops make up an unknown portion of current markets, and ecommerce is also not measured.

Many categories are difficult to track, like in pet food or cosmetic channels. What portion of CBD markets does Nielsen coverage represent? Perhaps below 10%, if you widen the scope to include pet foods, beverages, cosmetics, and smokable flower. Sales volume has increasingly shifted to ecommerce, and companies like Charlotte’s Web (CW) reported Q3 2020 revenues from ecommerce had increased 27.5% year-over-year.

Continuing with CW, in that same earnings report stated that revenue for that quarter was $25.2 million, representing almost 3x what is reported for that quarter by Nielsen. The consistent YOY figures are a useful barometer though. The chart below represents extraordinary growth from Jan 2018 to Jan 2019 – 956%. The following year throttled back to a healthy 280% increase over 2019. We anticipate January 2021 number to show a modest decline in YOY growth, but this does not represent the wider segment.

Wholesale flower sales alone may exceed $500 million in 2021. Retail flower markets will be several times this, as much as $1.2 billion. For comparison, the aggregate cannabis market was almost $18 billion in 2020. European markets add a new dimension to the US cannabinoid segment. US operators will connect with European buyers more and more in 2020.

Below are monthly sales figures, but do not include some of Nielsen’s other reporting, that may be assessed market values gained by assuming additional sales in product categories like pet food and treats.