11.21.2025

Sausage casings bulletin, November 21, 2025

...

**Please Note**Please contact Ryan Standard at 331.276.8227 or [email protected] with any questions on today’s report.**

Trading was lower on a number of cow selections today. Sources reported that bids for new sales continue to come in a lower than-last traded levels. A handful of sellers appear to be well sold and haven’t had to take the lower bids, but those needing to move material have crossed the spread and moved material at lower prices today.

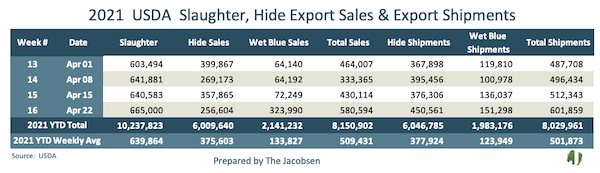

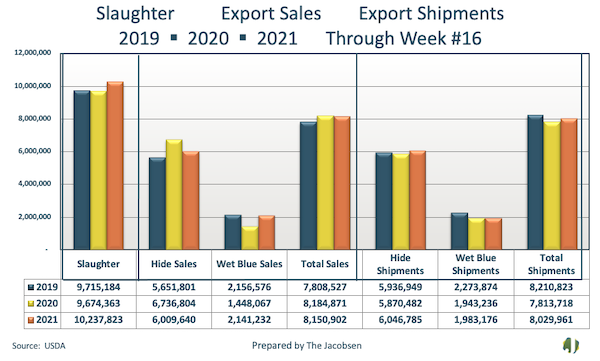

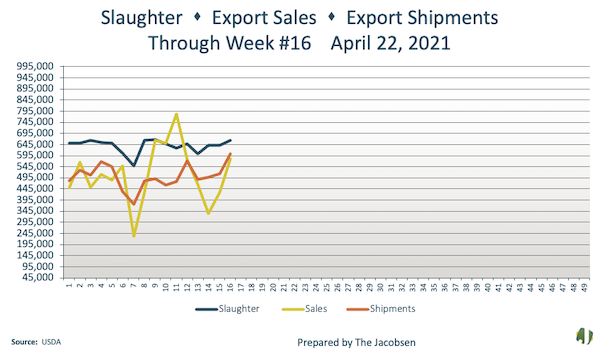

For week ending April 22, export sales for 2021 marketing year increased 35 percent to 580,594 from 430,114 and shipments increased 17 percent to 601,859 from 512,343. Sales for marketing year 2021 totaled 8,150,902—mostly all hides. The average year-to-date weekly trends for federally inspected slaughter were 638,864, total export sales were 509,431 and total export shipments were 501,873.

USDA Hides and Skins Report

Net sales of 256,600 pieces for 2021 were down 28 percent from the previous week and 27 percent from the prior four-week average. Increases primarily for China (90,000 whole cattle hides, including decreases of 14,700 pieces), South Korea (81,800 whole cattle hides, including decreases of 800 pieces), Mexico (42,800 whole cattle hides, including decreases of 900 pieces), Thailand (18,200 whole cattle hides, including decreases of 600 pieces), and Indonesia (7,700 whole cattle hides), were offset by reductions for Brazil (100 pieces) and Spain (100 MT). Exports of 450,600 pieces were up 19 percent from the previous week and 16 percent from the prior four-week average. Whole cattle hides exports were primarily to China (344,200 pieces), South Korea (39,400 pieces), Mexico (27,900 pieces), Thailand (15,600 pieces), and Taiwan (9,000 pieces).

Net sales of 324,000 wet blues for 2021 were up noticeably from the previous week and from the prior four-week average. Increases were primarily for Italy (144,900 unsplit, including decreases of 200 unsplit), Vietnam (99,700 unsplit, including decreases of 200 unsplit), Thailand (39,800 unsplit, including decreases of 200 unsplit), Mexico (20,000 grain splits and 2,600 unsplit), and China (14,900 unsplit). Exports of 151,300 wet blues were up 11 percent from the previous week and 16 percent from the prior four-week average. The destinations were primarily to China (54,900 unsplit and 2,300 grain splits), Italy (30,000 unsplit and 4,500 grain splits), Vietnam (26,600 unsplit), Mexico (13,700 grain splits and 4,400 unsplit), and Thailand (10,000 unsplit). Net sales of 1,219,300 splits reported for Vietnam (1,003,800 pounds, including decreases 2,300 pounds), Taiwan (169,800 pounds, including decreases of 2,400 pounds), and China (50,600 pounds, including decreases of 5,000 pounds), were offset by reductions for Italy (4,800 pounds). Exports of 509,200 pounds were to China (169,400 pounds), Vietnam (161,800 pounds), Italy (94,400 pounds), and Taiwan (83,600 pounds).

Link to Complete USDA Report: EXPORT-SALES/HIDESFAX

Argentina

Slaughter remains low.

Last week prices stabilized at Arg$76 per green fresh kg.

Also, good quality Buenos Aires wet salted steer prices are unchanged from last week at about US$085~0.90 per kg., which encourage some to start offering wet salted hides.

Demand for automobile upholstery leather remains firm. There was some businesses for footwear and apparel leather at low prices, which hardly cover costs with the current value of rawhide.

**Visit our International Hide & Leather Bulletin to see market news for additional countries across globe.**

HNS 61 MAX @ $54.00 OR 0.6900

BS 60/62 @ $39.00

BS 62/64 @ $35.00

BS 62/64 @ $40.00

BS 68 MIN @ $36.00

BS 68 MIN @ $41.00

BBS 62 MIN @ $52.00 OR 0.6550

HNS 58/60 @ $42.50 OR 0.5625

BS 60/62 @ $34.00

BBS 62 MIN @ $38.00 OR 0.4775

BBS 64/66 @ $47.50 OR 0.5700

NHNDC 50/52 @ $35.00 OR 0.5350

NHNDC 48/50 @ $29.00 OR 0.4625

SHNDC 50/52 @ $34.00 OR 0.5200

SHNDC 48/50 @ $28.00 OR 0.4450

NBC 50/52 @ $23.00 OR 0.3525

NBC 48/50 @ $17.00 OR 0.2700

SBC 50/52 @ $22.00 OR 0.3375

SBC 48/50 @ $17.00 OR 0.2700

Friday Early Publication Hours in Effect — Friday’s Trade Reporting Deadline 2 p.m. CST

Friday publication hours are in effect. The deadline for trade reporting will be at 2 p.m. CST with publication of the Hide & Leather Price Guide/Commentary soon after.