05.09.2025

Sausage casings bulletin, May 9, 2025

Runner market commentary

Table 1

Table 2

...

Demand for leather moved lower in July, which was directly reflected by the decline of hide prices. The contraction in global markets spilled over into Chinese equities which saw unprecedented volatility, as the Shanghai index whipsawed, notching up significant losses. In August, Chinese import and export data followed July’s declines, which reflects a continued contraction in economic prosperity. In the U.S. the data is more positive, with retail sales bouncing back in July, and shoe sales showing solid gains. Car sales data has been mixed year over year, but the sales number have been positive.

The Chinese Central Banks Drives Market Chaos

With a backdrop of the contracting Chinese economic growth, the People’s Bank of China reduced benchmark interest rates by 25 basis points, and reduced banking reserves as well. The goal is to provide liquidity in the hopes that economic growth will gain traction. Chinese regulators are also purchasing stocks on a daily basis in an effort to stabilize the market and provide a floor to reduce the negative volatility that appears to have gripped the large Chinese equity bourses.

In August, the People’s Bank of Chinese announce 3 consecutive devaluations of their currency the Yuan, which totaled 5%. Their reasoning was based on a normalization of their currency as opposed to the market perception that they are battling a current war in an effort to increase exports.

In the U.S. Retail Sales have been positive, and shoes sales bounced back in July after declining by nearly 12% year over year in June. The headline retail sales number have been pushed around by volatile gasoline prices which reflect sales as a value number as opposed to volume which means that changing prices greatly influence sales.

Car sales have been a bright spot for retail sales, and auto part sales have been very strong. Although the numbers continue to remain positive the year over year changes in car sales have been stable to negative.

At the time of writing the JLDI index, the Federal Reserve began their first day of their two day monetary policy committee meeting. It appears that expectations are split on whether the U.S. central bank will increase short term interest rates. Although a 25 basis points increase will likely not affect growth in the United States, higher yields could have a negative impact on Chinese demand, as a rising dollar will make imports of hides even more expensive.

In July, the JLDI index moved lower, coinciding with the decline seen in the price of hides. The JLDI index was created to shed some light on the demand component within the hide and leather market. As mentioned in our first release, the leather market is similar to many commodity markets as it is fundamentally driven by both supply and demand. While supply of leather is generated from hides and is relatively transparent, demand for leather is more opaque, as it is a function of consumer demand for products that contain leather which include shoes, furniture along with the automobile upholstery and accessories.

Total light vehicle sales increased in July along with furniture sales and shoes sales dropped. Chinese exports declined by 8.3%, which more than offset the slight gains in the other components.

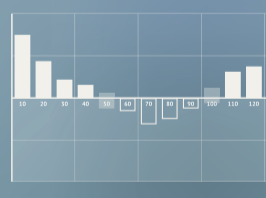

To produce an index that reflect perceived demand for leather, the JLDI combines changes in the shoes sales, furniture and automobile market given assumption made about the makeup of these markets as leather is concerned. Fluctuation in shoes sales, auto sales, and furniture sales will change the demand dynamic for leather globally. For example, above is a chart released by the Commerce Department which shows the changes in auto sales.