11.21.2025

Sausage casings bulletin, November 21, 2025

...

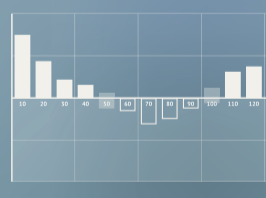

It was a tough and interesting year for the US hide market with sharp price declines influenced by domestic and global issues going back well into Spring 2014. The decline began with the cow hide market in late March, followed by steer hides in late September. Through 2015, prices continued to drop for all US hide selections with the steer and cow selections falling over 40% and 50% from their peak.

While the descent in hide prices in 2015 was similar to many commodities reacting to the economic slowdown in China, there were a number circumstances unique to the hide market. Included are environmental regulations in North China, troubles with hide contracts and opening LCs, a crashing split market and competition from other manmade materials.

Leading the US hide market decline were cow hide prices which began to fall about six months ahead of steers and heifers in March of 2014. During the time cow hide prices were beginning to drop, North China tanners started having serious issues with environmental regulations. It was widely reported in Spring 2014 that a lot of the smaller domestic China tanners―who by the way were big buyers of US cowhides―came under extreme pressure from the Chinese government to comply with environmental regulations. A number were forced to close shop or find other contractors to process hides. Many in the trade believe this was the trigger of the cow market decline.

Meanwhile, back in the US during the Summer 2014, West Coast ports were beginning to slow down as negotiations between labor unions and port operators stalled. In July 2014, the contract negotiations expired and while the ports continued to operate, congestion began. With most of the hides exported from the US funneling through these ports, US hide suppliers started feeling the pressure. Major disruption began to increase in late October with hide inventories backing up and many shipments not meeting terms of sales agreements. The ILWU and Pacific Maritime Association finally agreed on a tentative five-year deal on February 21, 2015; however, congestion lingered until the contract (K) was ratified May 18. Numerous overseas tanners scrambled to cover potential shortages caused by shipment delays and hedged by double buying hides from other regions including Europe, Australia and South America.

At the onset of 2015, US steer prices were coming off of record levels and as the hide market began to falter, there appeared to be a two-tiered pricing structure with preferential pricing given if buyers could arrange for shipment and unfavorable pricing for product channeled through West Coast ports.

With the pressure of record-high prices, leather buyers were telling tanners hide prices were forcing them to find other materials to make their products. Much of this was dismissed as buyer tactics, but de-contenting started to become a part of the landscape in 2015 and as the year winds down, it is widely conceded that demand is not sufficient to support higher prices and many believe much of the demand was lost to substitute materials.

For the second consecutive year, 2015 saw a major decrease in cattle slaughter with slaughter down around 5.5% from 2014, which was down 6% from 2013. Following major herd reductions caused by the droughts in the Southwest in 2013 and 2014, cattle herd numbers dropped to the lowest levels since 1951 by January 2014. In 2015, the US herd was in a rebuilding mode, but low cattle numbers kept live cattle prices high for most of the year, keeping slaughter at low levels.

Contract Issues

In 2015, US and overseas hide suppliers widely reported that while hide prices were falling, they were having a huge problem with many Asia customers not honoring sales contract commitments. Initially, some of the issues derived from people who had double booked hides in order to cover for shipment delays caused by the ports slowdown. But as the market continued to decline, contracts were flagrantly not honored, forcing resales and new price negotiations. Going into the New Year, this is an unresolved problem with the industry, adding a dimension of risk and chaos to the hide business.

Split Market

The demise of the wet blue split market in 2014/2015 played a major role in the trajectory of hide prices during that period. Splits are a byproduct of the tanning process for grain leather and wet blue splits are used to produce suede grain leather for a wide variety of products from shoes and garments to furniture. The revenue from split sales helps offset hide costs for finished leather tanners and as split prices decline, so does its contribution to offsetting the hide cost.

From a timing perspective, the decline of split prices is similar to the drop in cow hide prices beginning in Spring 2014. The top of the split market was in April 2014 and at its peak, tanners were able to realize in excess of $30 per split. As an example, 20-26 pound wet blue splits from US hides were selling for approximately $1.20 per pound or $29 per piece. Every split that was offered was taken immediately. By June that year, the bull market was over with all contracts filled and no buyer who wanted even one additional split at those prices. After a period of low sales, prices began to fall bringing on a period of no LCs for existing orders at high prices, claims and cancellations. By December that year, the bottom had dropped from the split market and the same splits were selling for around $0.90 or about $22, declining $7 per piece. In 2015, the split market continued to drop and at this time, the same split is selling for $0.65 per pound or about $15.60, going down another $6.40. The bottom line is that from the peak of the split market to today, revenue for drop splits has declined over $14 and in some cases over $20. In 2015, lighter splits were and remain extremely difficult to sell, but better quality heavier splits a little more easily marketed. As the year comes to an end, several people report they are currently seeing a spark of interest for heavier splits. Some of the lower-end markets have gone to “fake suede” and will be unlikely to come back for quite some time.

Leather Markets

With the exception of the auto leather sectors, in 2015 leather demand was down for most of the sectors. The downturn was led by the shoe leather sector which consumes the largest portion of hides, followed to lesser extent by furniture upholstery, bag and garment leather. China, the country that imports the largest amount of US rawhides at nearly 65%, saw a dramatic downturn in its domestic leather production as well as a slowdown in its leather exports. Europe was able to capitalize on the weaker Euro and the stronger US dollar to some extent, but it also saw a reduction in most leather goods with the exception of high-end auto. Most people in the hide and leather trade believe that the genesis of the hide market falling in 2015 boiled down to insufficient leather demand to support hide supply. As the year concludes, the market is in a little bounce with prices hovering a couple dollars from the bottom and looking for direction into the New Year. Demand will dictate the next course and that will largely be influenced by the direction of the global economy.