11.21.2025

Sausage casings bulletin, November 21, 2025

...

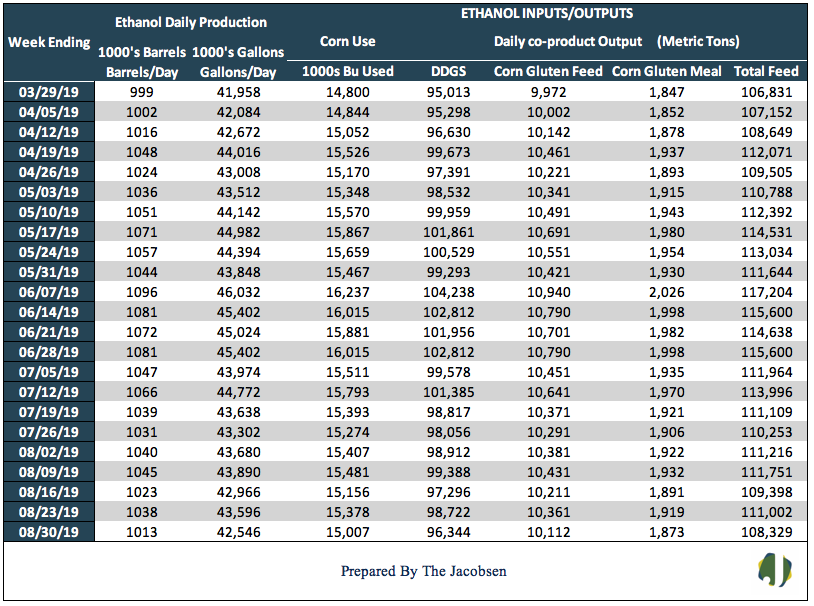

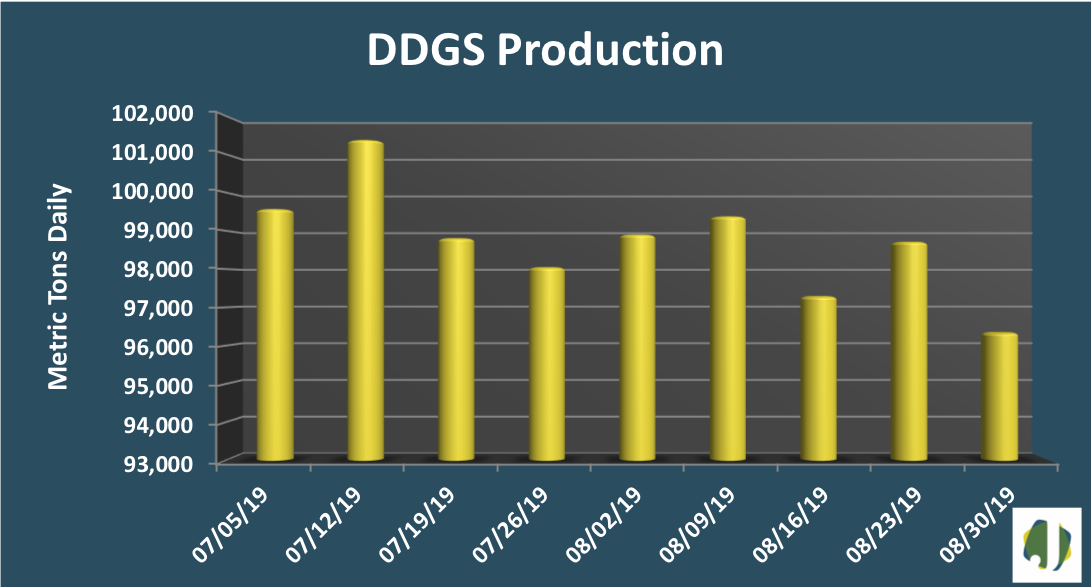

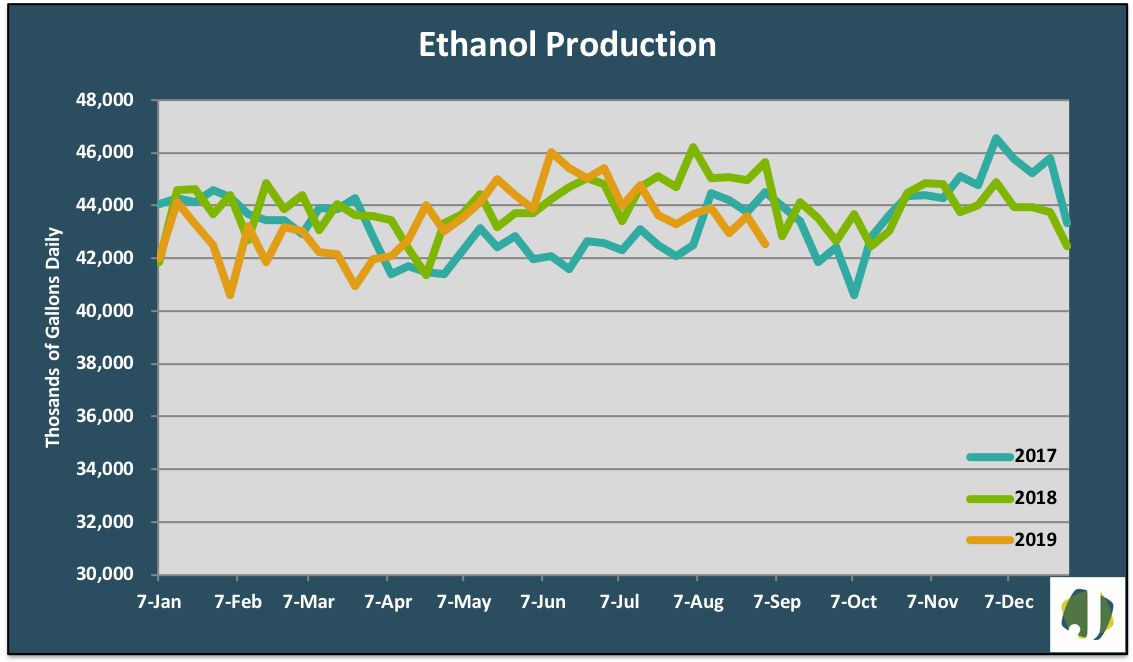

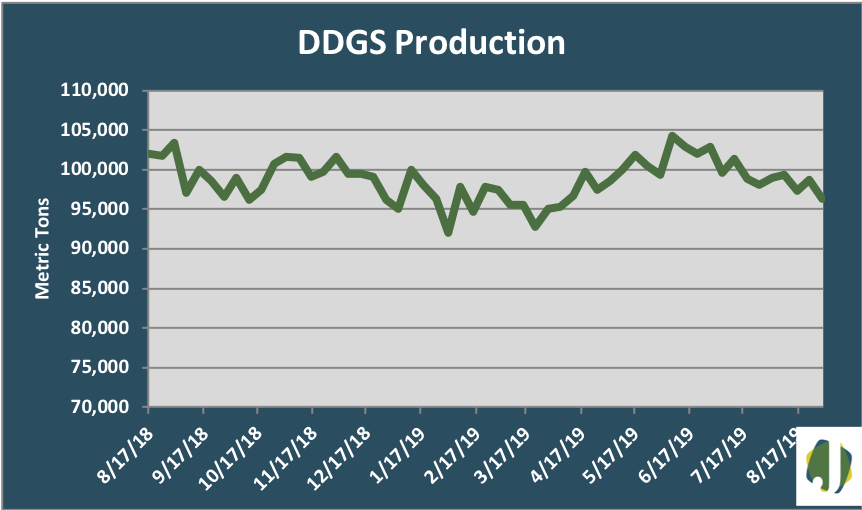

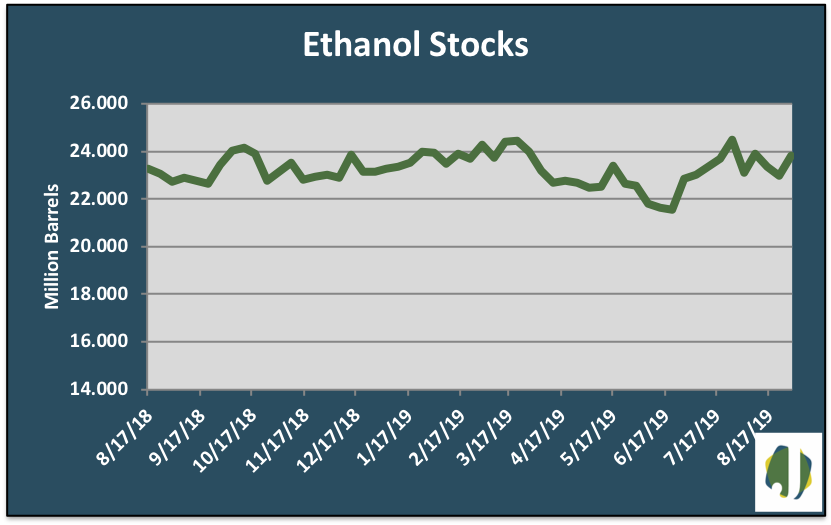

According to the EIA’s Weekly Petroleum Status Report, ethanol production began to feel the impacts of slowing production. Output fell 25,000 barrels per day to a 1.013 million-barrel-per-day average during the week ending August 30, 2019. Gasoline demand pulled back ahead of the Labor Day weekend, falling 4.3 percent to 9.5million barrels per day. Current gasoline demand is 2.7 percent below levels from a year ago. Ethanol stocks expanded 3.6 percent and are 4.8 percent over levels seen a year ago. Ethanol imports arrived for a second consecutive week, amounting to 7.6 million gallons on the West Coast. The decrease in ethanol production lowered corn demand by up to 370 thousand bushels per day. DDGS output moved in sync with ethanol production, declining by 2.4 percent for the week.

Ethanol output is averaging 1,032,629 b/d, down 577 barrels daily from last week and 13,679 barrels below the 2018 weekly average. The industry is on pace to produce 15.83 billion gallons, noticeably higher than the 2019 finalized ethanol renewable volume obligation (RVO) of 15 billion. The EPA’s use of the small refinery hardship exemption lowered this year’s RVO by 1.4 billion gallons and is causing producers such as POET and Marquis Energy to slow production and/or idle plants. The ethanol blend rate decreased to 10.48 percent. Average year to date gasoline demand during 2019 is 644,000 gallons per day below 2018 average demand.

Approximately 15 million bushels of corn were consumed daily in the production of ethanol and, as a co-product of production, 107,954 metric tons of livestock feed was produced daily. DDGS production accounted for 96,344 metric tons, with the balance comprised of 9,924 MT of corn gluten feed and 1,685 MT of corn gluten meal.

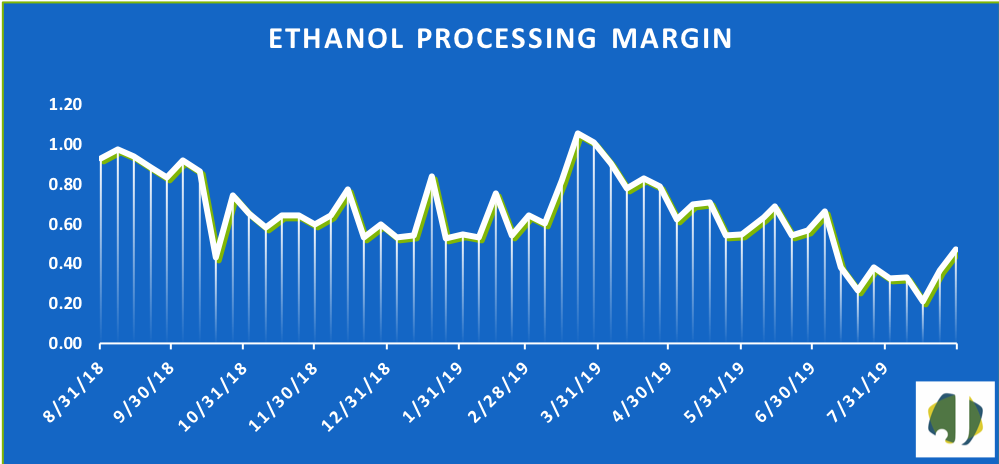

The estimated ethanol-processing margin increased 10 cents over the past week. Revenue derived from ethanol and DDGS sales increased from $4.96 per bushel to $5.01, while corn prices fell 5 cents per bushel to $3.95. This allowed the margin to expand 10 cents to 47 cents per bushel. The margin is 49 percent below the same 2018 period.