Sustainable Aviation Fuels Report

What is the report about?

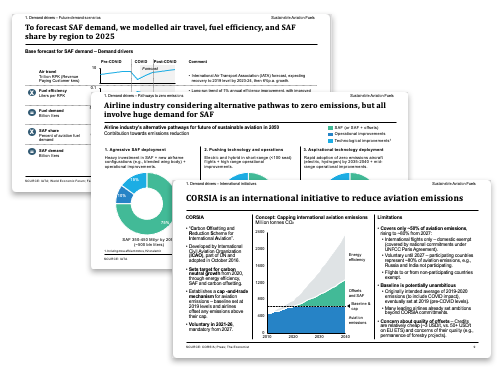

Sustainable Aviation Fuels (SAF) are fuels made from renewable materials and suitable for use in the aviation sector with no significant modification to engines. Airline commitments, consumer demand and expected government regulations are expected to cause an explosion in SAF demand in the coming 5 years. The aviation sector is under increasing pressure to reduce greenhouse gas (GHG) emissions and has ambitious targets including an industry-wide commitment for carbon-neutral growth from 2019 levels, and many airlines committing to net-zero emissions by 2050. While electric and hydrogen technologies are promising, they are many decades away from widespread deployment, and not expected to be possible for long-haul flights even by 2050. Other levers, such as more energy-efficient aircraft, airport operations, and carbon offsetting also have important limitations.

Sustainable Aviation Fuels (SAF) are fuels made from renewable materials and suitable for use in the aviation sector with no significant modification to engines. Airline commitments, consumer demand and expected government regulations are expected to cause an explosion in SAF demand in the coming 5 years. The aviation sector is under increasing pressure to reduce greenhouse gas (GHG) emissions and has ambitious targets including an industry-wide commitment for carbon-neutral growth from 2019 levels, and many airlines committing to net-zero emissions by 2050. While electric and hydrogen technologies are promising, they are many decades away from widespread deployment, and not expected to be possible for long-haul flights even by 2050. Other levers, such as more energy-efficient aircraft, airport operations, and carbon offsetting also have important limitations.

SAF is therefore a critical element of the aviation sector’s efforts to decarbonize. However, there are many challenges to successful upscaling of SAF production, including a) SAF currently costs 2-3 times more than conventional gasoline, b) many key raw materials, such as used cooking oils, are in short supply, c) there are only a handful of SAF plants in the world currently and the technology still in development.

This report offers perspectives on how SAF demand will grow to 2025 and what will drive that demand, the main production pathways for SAF production and how costs can be reduced, raw material supply and costs globally and how companies should approach procurement, extensive details around current and planned SAF production facilities, key challenges and scenarios for SAF market evolution. It also provides learnings from case studies of regulatory frameworks, SAF producers, and airlines to inform how these challenges can be best overcome.

Why now?

The SAF market stands on the cusp of unprecedented growth, with new regulation expected in 2021 from both the EU and US governments, to support the production and use of SAF. The industry is gaining enormous attention from financial institutions and investors, while important questions are also starting to be raised about raw material supply, supply chains, and how to quickly reduce SAF costs to approach conventional gasoline costs.

Key questions the report helps answer.

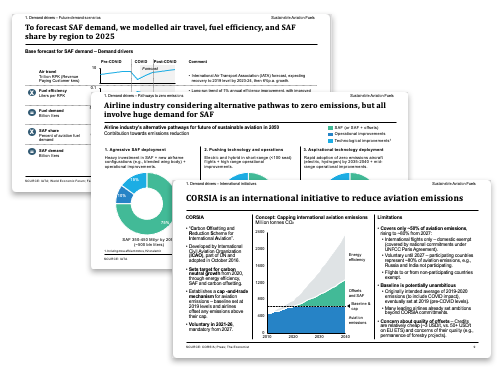

- How will SAF demand grow to 2025?

- What will be the most important drivers of SAF demand?

- How is SAF made and what raw materials are required?

- What is the supply potential and cost for key raw materials, by region and globally?

- Who are the main producers, and owners of projects for new capacity?

- How do planned SAF facilities plan to source raw materials, and how are they financed?

- What forces will shape how the SAF industry develops in the next few years? What are the alternative future scenarios for the SAF market?

- What can we learn from leading examples of government regulators, SAF producers and airlines using SAF?

Sustainable Aviation Fuels (SAF) are fuels made from renewable materials and suitable for use in the aviation sector with no significant modification to engines. Airline commitments, consumer demand and expected government regulations are expected to cause an explosion in SAF demand in the coming 5 years. The aviation sector is under increasing pressure to reduce greenhouse gas (GHG) emissions and has ambitious targets including an industry-wide commitment for carbon-neutral growth from 2019 levels, and many airlines committing to net-zero emissions by 2050. While electric and hydrogen technologies are promising, they are many decades away from widespread deployment, and not expected to be possible for long-haul flights even by 2050. Other levers, such as more energy-efficient aircraft, airport operations, and carbon offsetting also have important limitations.

Sustainable Aviation Fuels (SAF) are fuels made from renewable materials and suitable for use in the aviation sector with no significant modification to engines. Airline commitments, consumer demand and expected government regulations are expected to cause an explosion in SAF demand in the coming 5 years. The aviation sector is under increasing pressure to reduce greenhouse gas (GHG) emissions and has ambitious targets including an industry-wide commitment for carbon-neutral growth from 2019 levels, and many airlines committing to net-zero emissions by 2050. While electric and hydrogen technologies are promising, they are many decades away from widespread deployment, and not expected to be possible for long-haul flights even by 2050. Other levers, such as more energy-efficient aircraft, airport operations, and carbon offsetting also have important limitations.