11.21.2025

Sausage casings bulletin, November 21, 2025

...

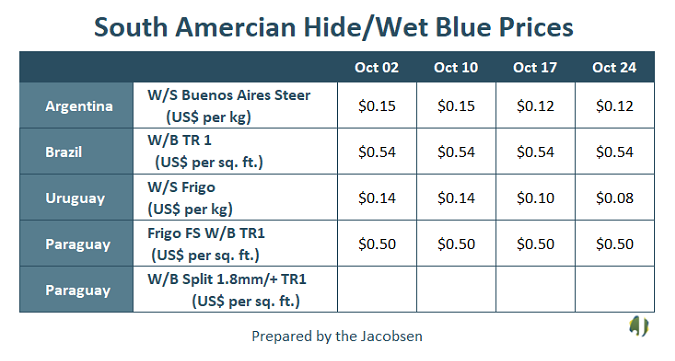

ARGENTINA: October 24

According to October’s usual data from the USDA report, which is reviewed later in April, Argentine beef exports will grow slightly more than 10% in 2020, reaching 775 thousand tons of carcass equivalent (tec). The figure represents 25% of domestic production, a share that has been recording uninterrupted increases from the 7% observed in 2015. With respect to 2019, the forecast is 700 thousand tec, a figure that is very favorably compared to the 580 thousand tec forecasted only six months ago for the same year.

Raw hides prices are unchanged from last week. Buenos Aires wet salted heavy steers continue quoting at about US$0.12 per kg.

Demand continues unchanged.

October 17

In September, 1.2 million head were shipped to slaughter, 2% less than in August, and 14% more compared to September 2018.

Raw hides prices are downward from previous weeks. Buenos Aires wet salted heavy steers are quoting now at about US$0.12 per kg.

Demand remains unchanged.

BRAZIL: October 24

Slaughter remains unchanged.

Good quality TR1 heavy wet blue hides from Mato Grosso remain quoting at US$0.50-$0.58 per sq. ft.

Demand is also unchanged.

October 17

The hides and skins exports presented by SECEX (Foreign Trade Secretariat), of the MIDC for the month of September 2019, registered the amount of US$80.8 million, which means a decrease of 28.1% over the same month last year, when total exports were US$112.3 million, and a reduction of 6.3% compared to August, when exports were 86.3 million.

Regarding the total exported in square meters, in September, 13.6 million were shipped, down 12.3% over the same month of 2018, when the total was 15.6 million m². The accumulated of the year is 0.1% above 2018.

Slaughter continues at good pace.

Good quality TR1 heavy wet blue hides from Mato Grosso continue quoting at US$0.50-$0.58 per sq. ft.

Demand remains unchanged.

PARAGUAY: October 24

This week started with a slight rise in the price of the beef carcass to US$2.70 per kg.

Slaughter remains firm despite shipments to Chile which are somewhat complicated due to lack of transport security as a result of the current political situation.

Leather sales continue at very low prices because of quality problems. It is very difficult to find TR1 selections owing to the low quality of the hides.

While the scarce wet blue TR1 heavy full substance hides prices continue unchanged at about US$0.50 per sq. ft., TR2 is sold at about US$0.45 per sq. ft. Best-selling selections in these weeks are the TR3 and the TR4.

October 17

In order to comply with strong beef shipments to Russia, Chile and Israel, slaughter continues to be very firm.

Wet Blue TR1 heavy full substance hides prices continue unchanged at about US$0.50 per sq. ft.

These low prices have created an extra problem for the Paraguayan leather industry. Farmers are giving poor care to the animal’s skin, which translate into a worrying decrease in obtaining TR1/TR2 selections, which are the highest paid. Pundits believe that nowadays, only 8% of these selections can be obtained from every processed lot.

URUGUAY: October 24

Last week (October 13-19), slaughter decreased 9% from the previous week to a total of 33,398 head. The accumulated slaughter volume for 2019 is 4% lower than the same period in 2018.

Rawhide prices are downwards from last week. Frigorificos fresh hides are quoting now at about US$0.08 per kg.

October 17

Last week (October 6-12), slaughter increased 14% from the previous week to a total of 36,777 head. The accumulated slaughter volume for 2019 is 4% lower than the same period in 2018.

Rawhide prices are downwards from previous weeks. Frigorificos fresh hides are quoting now at about US$0.10 per kg.

AUSTRALIA: October 23

The market in general remains slow with demand for hides weak. However, on a bright note, a few suppliers have improved positions and see more interest and inquiries. With prices as low as they are, some markets are re-appearing, which is giving some hope that business can be expanded beyond China. Domestic prices are unchanged the last two months–on the floor still with many light selections and very light cows worthless.

Dry weather is keeping kills steady, although some rains are appearing in the East. The Eastern State cattle slaughter for week ending October 18 was 151,076 head, up 11% on the week and 12% from the same week last year. By State, Queensland slaughter was 78,477; NSW, 35,641; Victoria, 28,029; South Australia, 4,027 and Tasmania, 4,902.

CHINA: October 18

The trade war seems to be easing a little, which was the first reaction from Chinese tanners. “Ease a little” was really what they thought of at the moment they all heard about ” tariff agreement.” However, many people are quick to point out that the biggest problem remains unchanged—the demand for leather in the world has been shrinking and it might continue this way. Therefore, the trade war does not hurt this business as badly as some claim.

With this idea in mind, many tanners are not feeling very positive about the hides/leather business for next few months. Quite a few strongly believe that the market will be under growing pressure again over the next few months all the way until the next Hong Kong leather fair.

At this moment, premium steer hides seems to be doing well, but are difficult to be sold at a higher price. The buying interest remains in China market as long as the November/early December shipment is offered at a steady or lower price (compared with the last trading price). However, very few Chinese tanners will consider buying hides with shipment after December while they are not feeling positive about future business. In fact, many feel that the market will possibly be very flat at best for next few months.

Cows hides are having a miserable time even though the price of some have reached the level around US$5 C&F China. According to many tanners, there is not much demand on most cow hides from the US and only a few premium HNDC and NBC might still find regular buyers to keep their price steady. These hide prices cannot go up at all even though the asking price on some offering lists look quite encouraging.

In general, minimal improvement is being noted in both the hide and leather market and it is believed that the market will remain this way through the rest of October.

October 11

Only a few packer top steer hide selections might still find enough Chinese buyers to keep prices steady. Most other hides offered by American sellers continue to find it difficult to keep moving in the market even though the price of some very low-quality hides—branded and conventional cows hides—are already at a record low since 2009 at US$5-$6 per hide C&F China.

Many people say the leather business remains very slow at the lion’s share of Chinese tanneries. People strongly believe that the American steer hide market will start to be under great pressure again in November and December because there will not be much follow-up business from Chinese buyers as the shoe leather business has hit its peak season.

It seems there is still new business confirmed here and there; however, almost everyone claims that while there is leather business, it is just not enough to keep a tannery running full time. The premium hides in the global market may be another story, although very few of Chinese tanners can handle this business. In addition, that market is so small that not many Chinese tanneries are needed.

Considering the on-going trade war and Chinese currency devaluation against US$, Chinese tanners hold a very negative view on of the future hides and leather business for next few months.

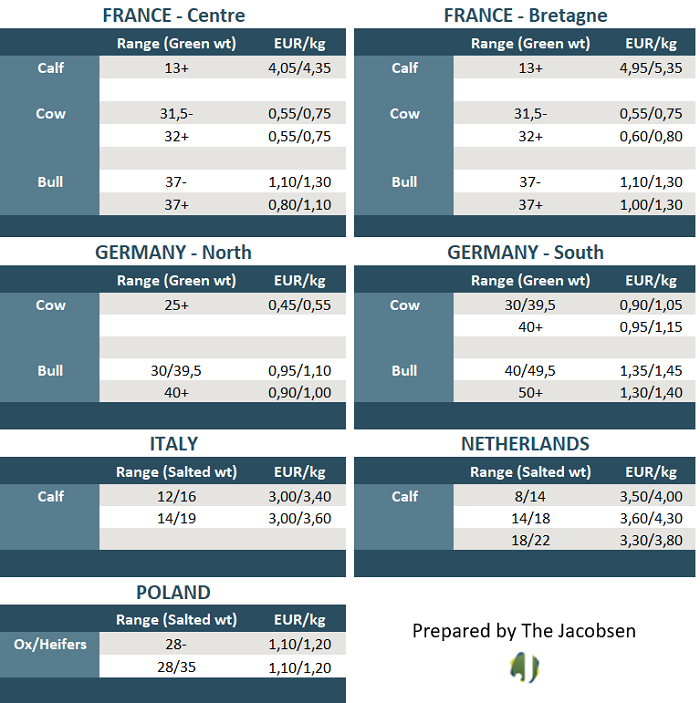

EUROPE: October 16

The European hide market is still very quiet. Some might have expected the Lineapelle fair in Milan to be a possible turning point in the leather business. It can be said in all honesty, that this was not the case.

Even though a satisfying number of trades have been closed, the operators mostly remain skeptical about a possible market change in the short term. The impression from the fair, which has been confirmed by other colleagues, was that tanners were way more interested in meeting potential customers rather than spending their time with agents or suppliers. This is hardly surprising, and it confirms what has been heard from the tanners: orders for finished leather are becoming an increasingly worrying issue. The month of September has been worse than expected in terms of demand, and this surely did not contribute to improving the mood at the fair.

The good news is that the beginning of October appeared slightly better than the end of September. Some orders have finally arrived, and some European material has been sold.

Operators specializing in French and German bulls report an acceptable amount of sales over the last few weeks. This convinced sellers to increase the asking price. Nevertheless, buyers refused to pay more—which is the reason why the price of this material remains unchanged compared to what was reported two weeks ago.

Orders of Polish ox/heifers are steady, and so is the price. This material can be purchased fresh, which is becoming increasingly important for European tanners. Environmental regulations are becoming very strict about the amount of salt that tanneries are allowed to discharge into the effluent, and the tendency is to use fresh hides instead of wet salted hides whenever possible.

Cow remains under pressure, and all operators confirm that the global demand for this material is still very low.

October 3

Today is the second day of the Lineapelle fair in Milan, which will end tomorrow (Friday). While it is surely too early to have a complete overview about its final outcome, there are a couple of hints one is already able to collect from the operators. In the first place, the overall attendance is satisfying: most booths are full, and tanners are busy meeting up potential customers as well as suppliers. In spite of this positive element, it is, however, undeniable that the amount of orders for finished leather following summer vacations did not match the expectations. Most tanners were indeed hoping for a slight increase of business volume in the month of September, but unfortunately this was not the case.

Such an unexpected slowdown makes tanners careful when it gets to purchasing new hides, in spite of the very low price of most origins and material, the hope is that, by the end of the month, some more orders will finally come and the leather industry will be able to get back some more pace.

French cow price is reported steady since they are at rock bottom level (the only exception is Bretagne 32+, reported 0,05€ lower than two weeks ago). German cows are 0,05€ lower on the heavy southern material.

German bulls price is reported to be slightly increasing, 0,05€ higher on the lower end of the price gap.

Italian calf price is also moving. On the one hand, the 12/16 are decreasing 0,10€. On the other hand, the 14/19’s gap is increasing with a +0,10€ for the best production against the -0,10€ of the lower end of the gap. The impression is that the market is adding value to higher-quality material and depreciating the lower quality, which is the reason for gaps becoming wider. French calf price is reported decreasing 0,05€ on both Bretagne and Centre origin.

Polish Ox/Heifers are 0,10€ up compared to two weeks ago.

UNITED KINGDOM: October 24

No major changes to report from the UK; although, there does appear to be increased interest from Europe and Asia for both medium- and heavy-weight hides. However ,while there is now more interest, the price level for hides remains unchanged and any requests for price increases are met with silence.

Brexit uncertainty remains even though it looks likely that there will be at least a small extension to the October 31 deadline.

No major price changes are expected in the short term.

Wet salted ox/heifer avg 30/32 kg @ US$30-$33 per pce C&F Asia

October 10

The sellers who were looking to obtain significant increases from Italian tanners last week have now had to re-evaluate their ideas. If they are fortunate, they may obtain 2-3 pence more on good heavier selections. The Far East tanners have been a little more active and some have now matched the levels of the Italian tanners. Again, the interest is for the heavier weights. Lighter weight hides remain very difficult to sell.

There is a lot of Brexit uncertainty among sellers regarding shipments after October 31, so it is likely that sellers will be looking to sell some of their ‘Italian/European’ allocation to the Far East until Brexit is clarified.

Wet salted ox/heifer avg 30/32 kg @ US$29-$32 per pce C&F Asia