06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

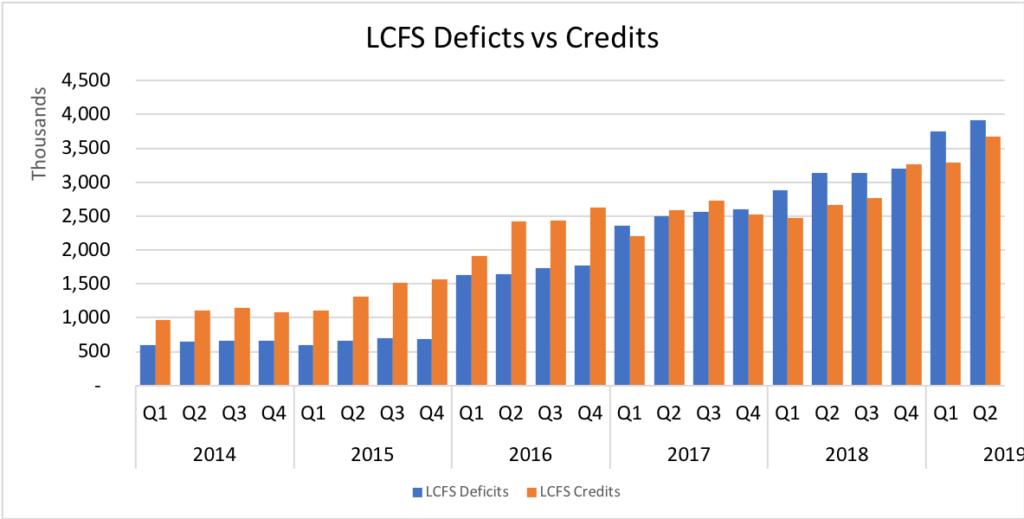

California’s Air Resources Board (CARB) released second quarter production data for the Low Carbon Fuel Standard (LCFS). Second quarter credit output was 12 percent over the first quarter and 38 percent over second quarter 2018. Deficits also moved higher. Second quarter deficits were five percent over the first quarter and 25 percent over the second quarter of 2018.

Credit production of 3.67 million was above CARB’s forecast of 3.39 million. The majority of the credits were produced in five categories:

Deficits creation was 81 percent CARBOB, 17 percent diesel, and two percent ethanol.

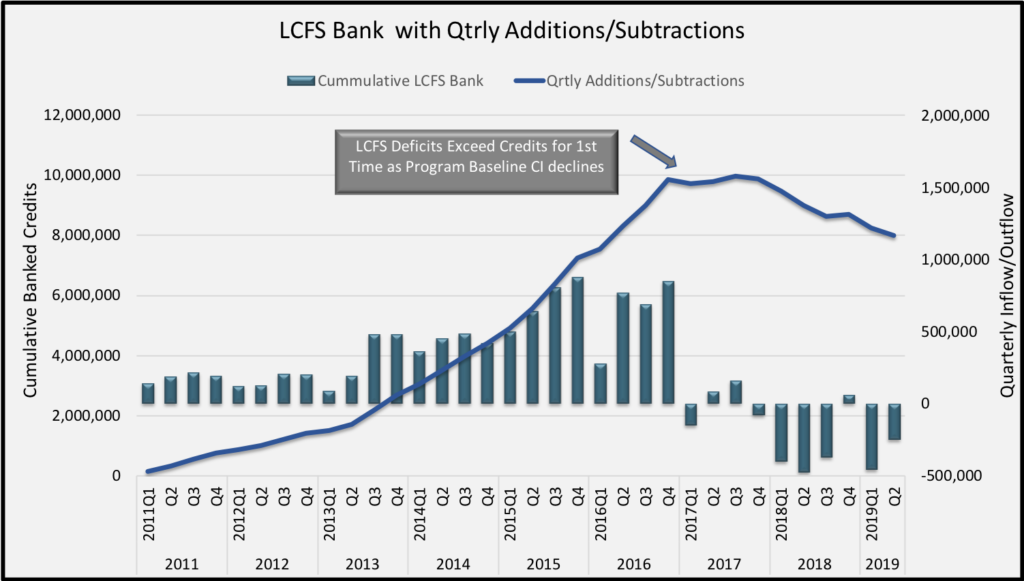

Stronger credit output wasn’t enough to prevent another quarterly drawdown from the credit bank. Second quarter credits were 247,086 less that deficits. This was a 54 percent improvement from the first quarter, which saw a credit drawdown of 455,553 credits. The credit bank is just below 8 million and about two million below its high of 10 million, which was set at the end of the third quarter in 2017.

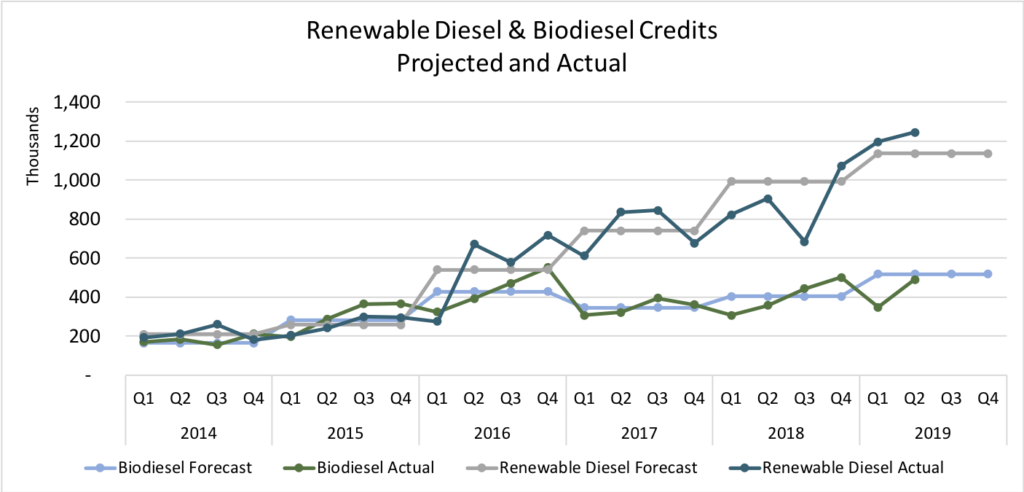

Biodiesel has been an underperforming fuel class while renewable diesel and ethanol have been over performers. Biodiesel credit production of 490,163 in the second quarter was up 41 percent from the first quarter and 37 percent over second quarter of 2018. Despite the second quarter rise, output was still below expectations. CARB had been expecting biodiesel credit generation to reach 518,071.

Renewable diesel credit generation more than compensated for the underachieving biodiesel segment. There were 1.25 million renewable diesel credits created in the second quarter, up four percent from the first quarter and 38 percent over second quarter 2018 output. Renewable diesel credit generation exceeded forecast by 108,982 credits while biodiesel credit generation fell 27,908 below expectations.

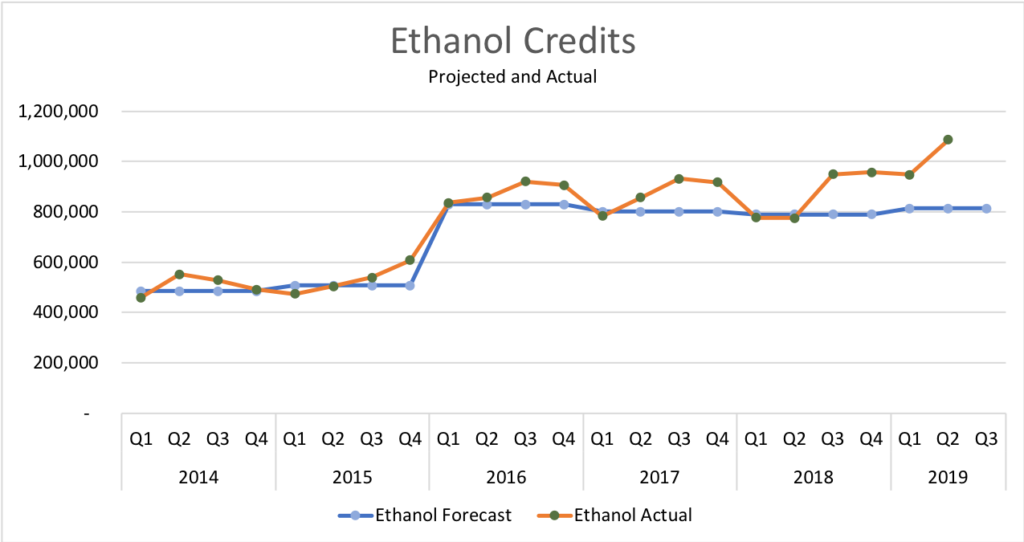

Ethanol credit production, especially in the under 65 carbon intensity segment, was better than expected. Second quarter ethanol credits were up 15 percent from the first quarter and 40 percent over second quarter 2018. Ethanol with a CI under 65 saw credit production increase 72 percent in the second quarter and was 541 percent higher than in the second quarter of 2018. Sugarcane ethanol imports were a strong factor in the under 65 CI production. Total ethanol credits of 1.09 million were 272,928 over forecast for the second quarter.

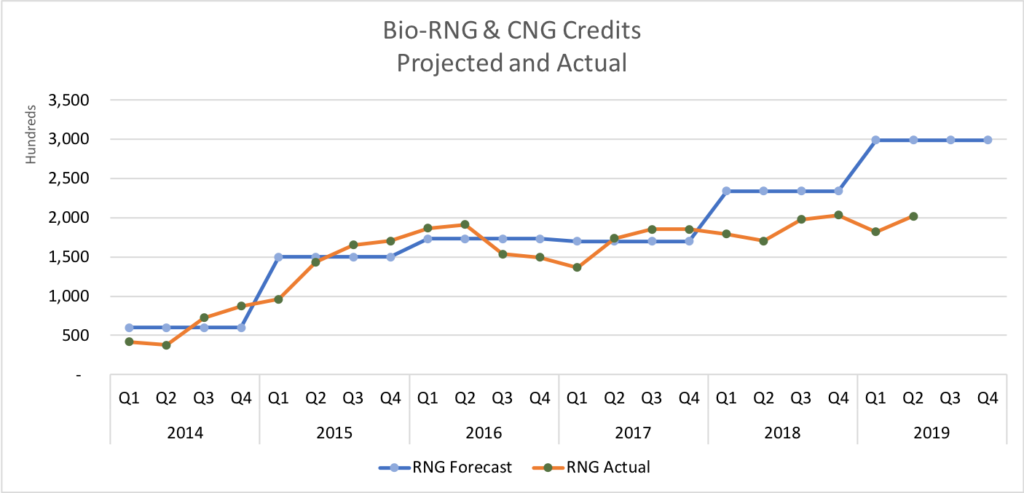

Bio CNG/LNG production continues to rise slower than anticipated. Biomethane accounts for five percent of the program credits, which is down a point from last quarter despite an eleven percent rise in credit generation during the second quarter. CARB expectations had been for 299,013 second quarter credits, roughly 97,000 more than the 201,820 created.

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...