11.21.2025

Sausage casings bulletin, November 21, 2025

...

Distiller’s dried grains are a by-product of the distillation of alcohol from grain, primarily corn in the marketplace. Distilleries produce a variety of alcoholic beverages, industrial ethanol, and ethanol biofuel. Distiller’s dried grains go by a variety of names but the most prevalent is distiller’s dried grains with solubles, or DDGS for short.

By-products from the distillery process have a long history in the animal feed market. At one time these products were considered waste streams but began gaining importance in the early 1900’s. The first study about feeding distillers grains to cattle was published in 1907 by Ohio State University. The advent and growth of the biofuels industry has made DDGS an integral force within the feed industry. DDGS are now the dominant distillery by-product of dry-mill ethanol production.

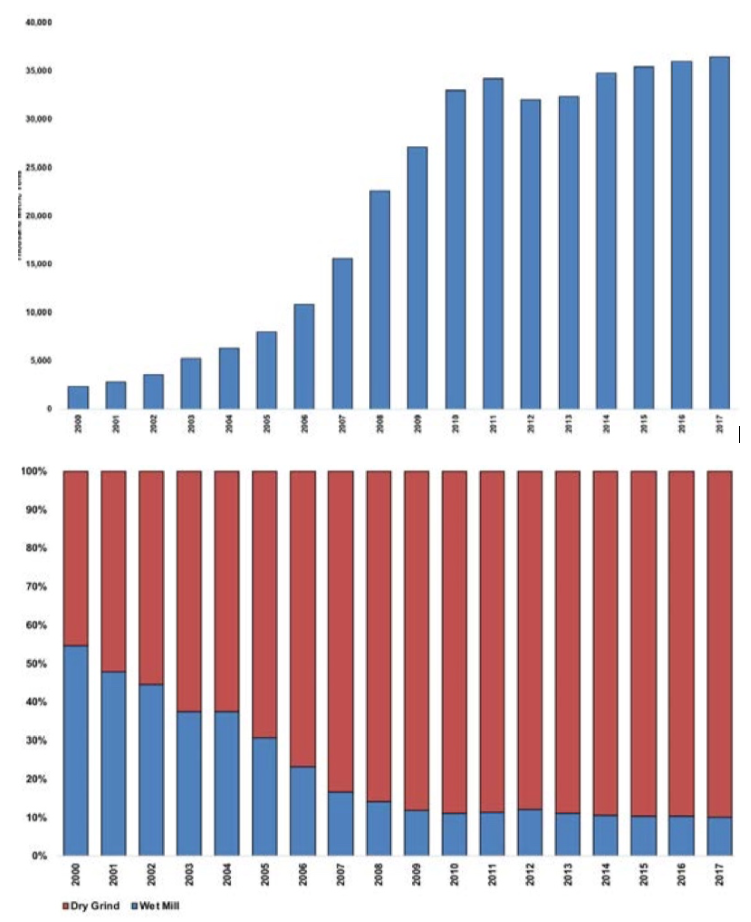

The US market produced two million metric tons of corn distillers’ grain in 1992, with 40 percent of production from alcoholic beverages and 60 percent from biofuel production, according to animal feed resources information system. By 2010 the US was the dominant world producer of corn-based ethanol and the market yielded more than 30 million metric tons of DDGS. (Graph – U.S. Grains Council)

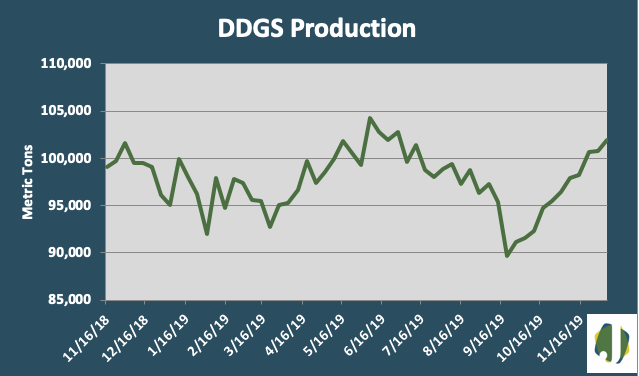

Today, U.S. ethanol plants have the capacity to produce more than 15 billion gallons of ethanol and 44 million metric tons of DDGS. The Jacobsen reporting on DDGS over the first 11 months of 2019 indicates that more than 33 million metric tons of DDGS have been produced this year.

DDGS supply is a co-product of ethanol production and will fluctuate based on market expectations for ethanol demand. In early August, the Environmental Protection Agency (EPA) granted fuel producers 31 exemptions from having to blend renewable fuels into the US fuel supply. This exempt more than 1.1 billion gallons of ethanol from the mandated blending amount of 15 billion gallons.

There is plenty of data showing that ethanol, even without a blending mandate, will continue to be blend into the U.S. fuel supply due to it being cost effective for fuel producers to do so. However, the use of these waivers had initially caused some ethanol producers to stop or slow production. EPA’s use of these waivers has and could continue to effect DDGS output.

The Jacobsen believes that DDGS production will likely continue to be strong. Ethanol supply is expected to remain at or near 15 billion gallons a year and due to the market’s reaction to the EPA’s use of waivers, EPA is supposedly working on a way to guarantee that all future blending mandates will be met.