11.21.2025

Sausage casings bulletin, November 21, 2025

...

Weekly Recap – Grain Prices Rise on Reduced Acreage and Weather Concerns

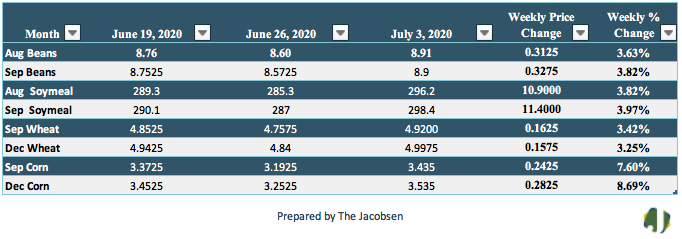

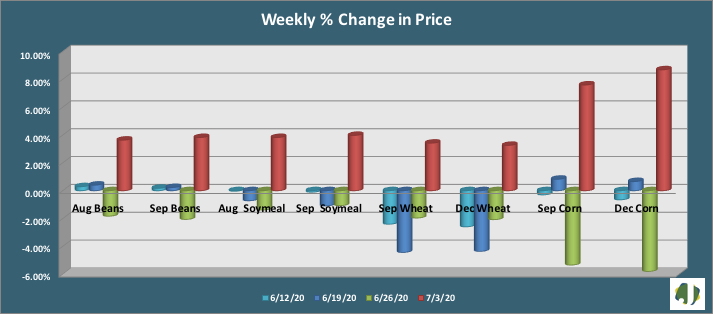

Soybean futures reached a four-month high after the June 30 acreage report came in lower than expected. This week, weather risk is supporting prices as 90-degree temperatures settle in across the Midwest. Last week, soybean prices advanced 31.25 cents per bushel for the August contract and 32.75 cents for September, pushing values to their highest level since early March. Export sales have moved lower over as China backed out of the grains market. Friday’s Commitment of Traders (COT) report showed managed money rapidly reduced short holdings during the week. Short positions were fell 14,713 contracts while long positions increased 8,389, boosting the overall long position 109 percent to 44,285. Price resistance is seen at $9.26 versus support at $8.80. Futures finished the week 21 cents per bushel above values seen at this time last month and 15 cents over pricing two weeks prior. Prices are higher this morning as the market reacts to potential upcoming weather issues.

Soybean meal futures advanced nearly four percent on a weekly basis, reaching their highest weekly close since April 10. Meal prices rallied $10.90 to $296.20 per ton for August and $11.40 to $298.40 for Sep. Strong economic signals from China are helping to support meal values despite relatively soft demand in the export market. Hedge fund managers are cautiously reducing short exposure. Short holdings were reduced 2,192 contracts and the overall net short position in the market declined five percent to 46,012 contracts. Meal prices are up $4.70 per ton over the past month and $6.90 per ton over the prior two-week period. Price support is seen at $295 with nearby resistance at $309.

Corn futures saw the largest percentage price gains over the past week with values rising 7.6 percent for the September futures contract and 8.7 percent for December. Prices are trending higher this morning on weather concerns. Ethanol production continued to rise over the past week, helping to support corn. Corn values handily broke through prior price resistance on reduced planting projections from the June 30 USDA Acreage report. Price support seen at $3.52 and resistance at $3.65. Futures prices are eight cents per bushel over values from a month ago and six cents above pricing two weeks back. Friday’s COT report showed managed money add two percent to their overall short holdings, increasing short positions by 11,892 contracts. Net short holdings are 277,479 contracts. If planting acreage for corn fall more than the market expects, there could be substantial pressure to begin unwinding some of the short exposure in the futures market.

Wheat futures climbed more than three percent on a weekly basis, erasing two out of the past three weeks in price decline. Russia downgraded their harvest yield estimates on drought concerns. Wheat prices increased 3.4 percent to 4.92 cents per bushel for the September contract, a gain of16.25 cents over the past week and eight cents per bushel over values from a month ago. Prices are eight cents per bushel over values from two weeks ago. Price support is at $4.67 with resistance at $4.99. Hedge Funds increased net short holding 59 percent to 48,213 contracts. Short positions climbed 14,082 contracts while long holdings declined 3,880.