11.21.2025

Sausage casings bulletin, November 21, 2025

...

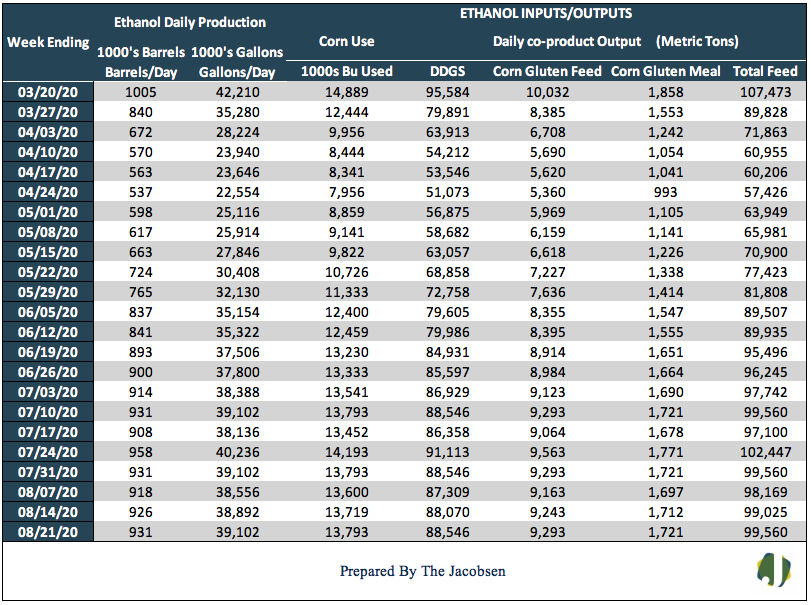

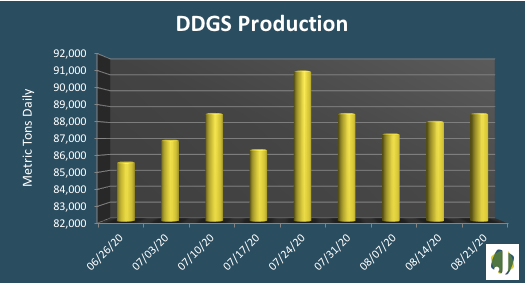

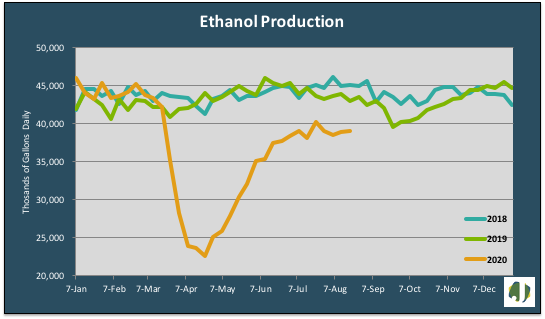

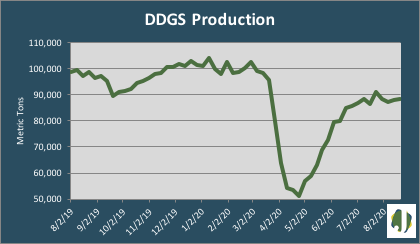

Ethanol production increased 5,000 barrels per day to a 931 million-barrel-per-day average during the week ending August 21, 2020. Ethanol and DDGS output reached a three-week high while gasoline supply reached its highest level since the pandemic began. Ethanol production edged 0.5 percent higher but was 10 percent below levels at this time last year. DDGS output increased by 476 metric tons per day but was 11,403 MT below production from a year ago.

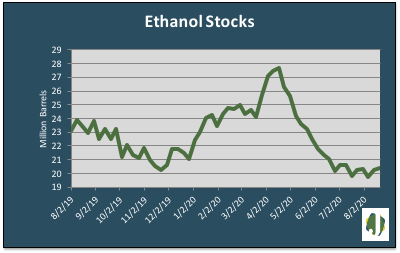

Gasoline supply increased six percent from the prior week but is seven percent below 2019 levels for the same weekly period. Ethanol stocks edged 0.7 percent higher after hitting a near-term low two weeks back. Ethanol imports resumed on the West Coast with more than 3.5 million gallons arriving during the past week. The increase in ethanol output raised corn demand by 74 thousand bushels per day. DDGS output moved with ethanol production, rising 0.5 percent for the week.

Ethanol output is averaging 888,829 b/d per week during 2020, up 1,241 barrels daily from last week but 139,710 barrels below 2019 average weekly production. The ethanol blend rate narrowed to 10.1 percent. Average year to date gasoline demand is 55.2 million gallons per day below 2019 average demand.

Approximately 13.8 million bushels of corn were consumed daily in the production of ethanol and, as a co-product of production, 99,215 metric tons of livestock feed was produced daily. DDGS production accounted for 88,546 metric tons, with the balance comprised of 9,121 MT of corn gluten feed and 1,549 MT of corn gluten meal.

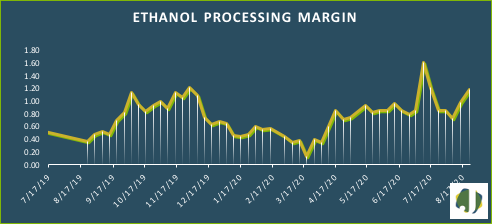

The estimated ethanol-processing margin increased sharply last week as ethanol prices continued higher. Revenue from ethanol and DDGS sales increased from $4.76 to $5.07 per bushel while the cost of corn increased 12 cents to $3.30 per bushel. This allowed the margin to expand 19 cents to $1.18 per bushel. The estimated margin is noticeably above levels from year ago.