06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

Weekly Recap

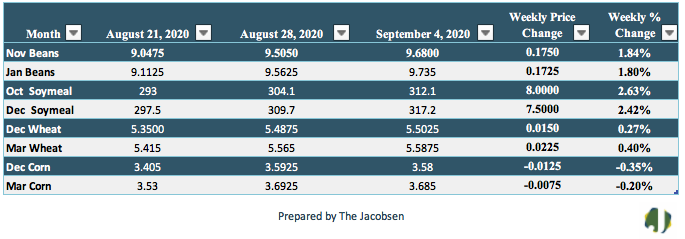

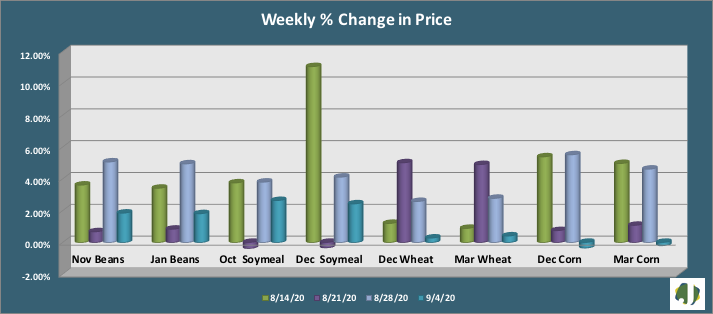

Soybean futures continued higher on a weekly basis for a fourth consecutive week. The November and January futures contracts have climbed nearly 12 percent during the period and are trading at a two-year high. Reduced yield expectations and strong export demand is pushing values higher. Soybean prices climbed 17.50 cents per bushel for the November futures contract and 17.25 cents for the January. Price resistance is seen at $9.85 versus support at $9.25 for the November futures contract. Friday’s close was $1.01 per bushel over values from a month ago and 63 cents above pricing two weeks back. The latest Commitment of Traders (COT) report showed managed money increased net long holdings 49 percent to 162,607 contracts.

Soybean meal futures pushed higher for a second consecutive week, gaining nearly three percent in value for the October future contract last week. The October soybean meal contract was up $8.00 per ton to $312.10, while the December contract gained $7.50 to $317.20 per ton. October meal prices are $28.60 per ton over values from a month ago and $19.10 above pricing two weeks back. Price support is seen at $312 and resistance at $322. Hedge fund managers increased net long holdings 15,871 contracts, up from 3,207 last week.

Corn futures moved lower on a weekly basis for the first time in four weeks. Over the past week, hot dry weather has increased production concerns and strong export demand has raised supply concerns. Support is seen at $3.39 versus resistance at $3.65. Ethanol production declined nine thousand barrels per day as margins pulled back from a seven-week high. Corn futures are 37 cents per bushel over values from a month ago and 18 cents per bushel over values from two weeks back. Friday’s COT report showed managed money aggressively reduced short exposure, shedding 72,889 short contracts and moving from being net short 61,489 contracts to being net long 18,659.

Wheat futures increased in value on a weekly basis for a fourth consecutive week. Strong export demand and dry weather across the Pacific Northwest and Northern Plains last week are helping to support pricing. Australia released news of an expected good harvest this year, following several years of poor harvests. Wheat values climbed three percent for the December and March futures contracts and is up nine percent in value over the past four weeks. Futures advanced 5.50¼ cents per bushel for the December futures contract and $5.58¾ cents per bushel for the March. December wheat is 47 cents per bushel over values from a month ago and 15 cents per bushel over pricing from two weeks ago. Price support is at $5.40 with resistance at $5.63. Hedge Funds added to long holdings while reducing short positions last week, moving from net long 1,517 to net long 32,469.

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...