11.21.2025

Sausage casings bulletin, November 21, 2025

...

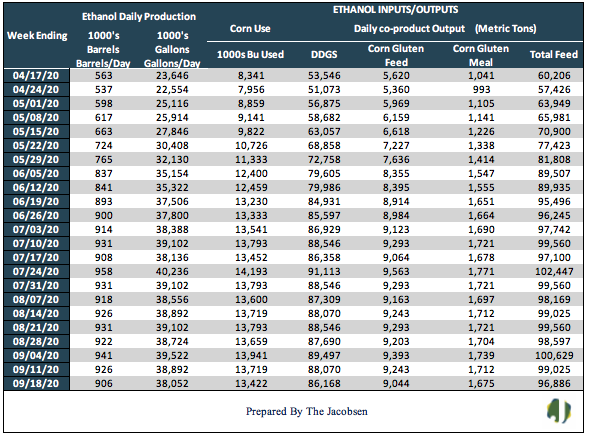

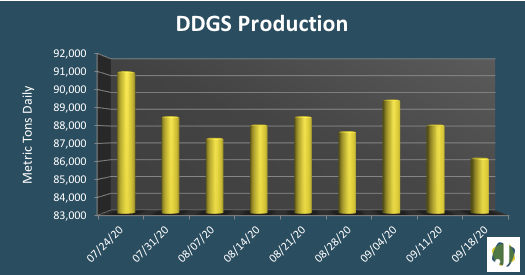

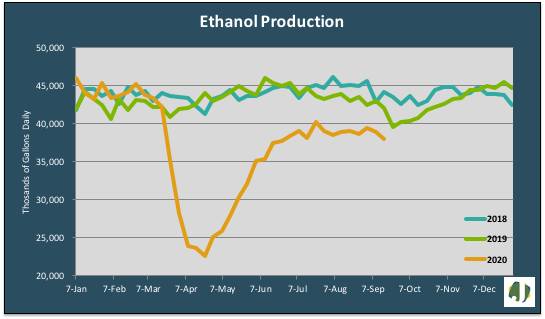

Ethanol production fell 20,000 barrels per day to a 906 million-barrel-per-day average during the week ending September 18, 2020. Ethanol and DDGS output hit a 12-week low as concerns over oil supply combined with fall maintenance appeared to be slowing output. Ethanol production was 2.2 percent below last week’s report and four percent under levels at this time last year. DDGS output decreased 1,902 metric tons per day and was 3,519 MT below production from a year ago.

Gasoline supply edged lower and was nine percent below 2019 levels for the same weekly period. Ethanol stocks experienced a one percent build to 20 million barrels. Ethanol imports continued, reaching 3.2 million gallons on the West Coast. The decline in ethanol output reduced demand 296 thousand bushels per day. DDGS output moved with ethanol production, falling 2.2 percent for the week.

Ethanol 2020 output is averaging 892,410 b/d per week, up 357 barrels daily from last week but 136,128 barrels below 2019 average weekly production. The ethanol blend rate narrowed to 10.6 percent. Average year to date gasoline demand is 53.2 million gallons per day below 2019 average demand.

Approximately 13.4 million bushels of corn were consumed daily in the production of ethanol and, as a co-product of production, 96,551 metric tons of livestock feed was produced daily. DDGS production accounted for 86,168 metric tons, with the balance comprised of 8,876 MT of corn gluten feed and 1,507 MT of corn gluten meal.

The estimated ethanol-processing margin narrowed for a third straight week as rising corn cost exceeded revenue growth. Revenue from ethanol and DDGS sales increased from $5.33 to $5.34 per bushel while the cost of corn moved 10 cents higher to $3.74 per bushel. This allowed the margin to narrow eight cents to $1.01 per bushel. The estimated margin is 46 percent above levels from year ago.