11.21.2025

Sausage casings bulletin, November 21, 2025

...

Weekly Recap

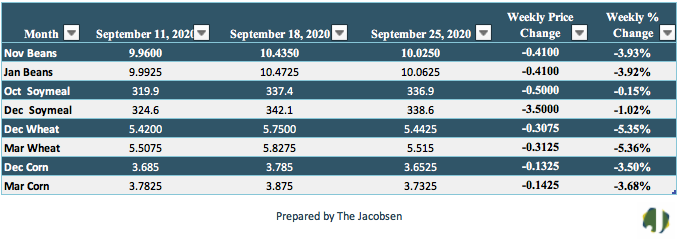

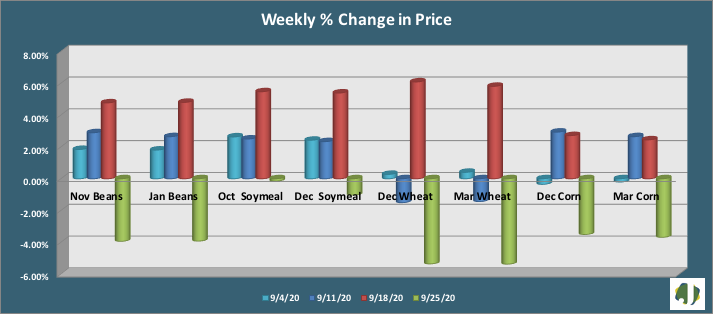

Soybean futures closed lower on a weekly basis for the first time in seven weeks. Pricing appreciated 20 percent during this prior six-week period but could not sustain momentum during the seventh week. Export activity has taken a backseat to the harvest outlook. Combines have been rolling through most of the Midwest and are expected to generate strong harvest data in this afternoon’s report. Soybean prices fell four percent per bushel for the November and January futures contracts, offsetting most of the prior week’s gain. Price resistance is seen at $10.47 versus support at $9.85 for the November futures contract. Friday’s close was $0.52 per bushel above values from a month ago and six cents over pricing two weeks back. The latest Commitment of Traders (COT) report showed managed money shrugged off market selling while adding to long positions in the futures market. Net long holdings climbed 10 percent to 211,143 contracts.

Soybean meal futures ended four consecutive weeks of price gains with the October futures contract closing the week fractionally lower and the December contract down one percent. October soybean meal futures slipped by 50 cents per ton to $336.90. Soybean meal prices are $32.80 per ton over values from a month ago and $17.00 above pricing two weeks back. Price support is seen at $321 and resistance at $341. Hedge fund managers boosted net long holdings 49 percent to 65,248 last week.

Corn futures pulled back 3.5 to 3.7 percent for the December and March futures contracts, hitting a three-week low for weekly closing values. Hot and dry weather has had the crop maturing rapidly and the market is looking for a better than average harvest pace in the crop progress report this week. Price support is seen at $3.62 versus resistance at $3.83. Ethanol production pulled back to 906 thousand barrels per day, a 12-week low, on oil production concerns. Corn futures are six cents per bushel above values from a month ago but three cents per bushel below prices from two weeks back. Friday’s COT report showed managed money remained bullish corn, adding 37,356 contracts to their net long futures position. This was a 64 percent increase to the overall net long position as 16,127 long positions were added while 21,229 short positions were taken off.

Wheat futures fell more than five percent as global stocks are strong and US production may lead to a further increase in stocks. Strong export demand may offer support to values. Wheat pricing fell 5.4 percent for the December futures contract, more than offsetting the prior week’s gain. December wheat is four cents per bushel below values from a month ago but two cents per bushel above pricing two weeks back. Price support is at $5.40 with resistance at $5.78. Hedge Funds reduced long holdings for a third consecutive week. Long positions were trimmed 1,312 contracts while 1,881 short contracts were added. This reduced net long exposure four percent to 14,543 contracts.