11.21.2025

Sausage casings bulletin, November 21, 2025

...

Weekly Recap

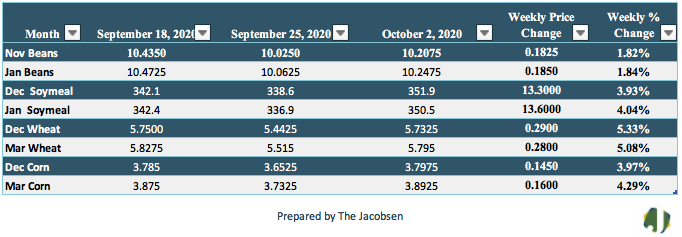

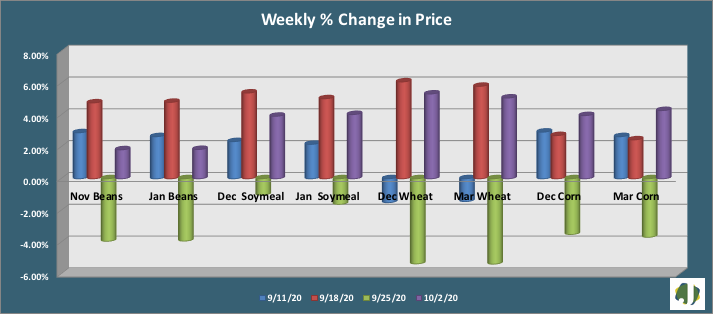

Soybean futures advanced two percent last week, offsetting half of the prior week’s weekly decline. The USDA’s Sept 30 grain stocks report showed an aggressive decline in soybean stocks, which helped support pricing. Soybean stocks are at 523.5 million bushels versus 909 million in September of 2019, a 42 percent decline. The larger than expected decline in stocks underpinned values and reversed pricing that was trending lower prior to the report release. Harvest activity has increased due to the hot and dry August weather, which has dried out soybeans and made soybeans available sooner for harvest. Exports remain firm and were just beyond expectations last week. Price resistance is seen at $10.48 versus support at $9.84 for the November futures contract. Friday’s close was $0.53 per bushel above values from a month ago but 23 cents below pricing two weeks back. The latest Commitment of Traders (COT) report showed managed money remained bullish, adding to long positions and reducing shorts in the futures market. Net long holdings climbed eight percent to 229,043 contracts.

Soybean meal futures rallied on reduced acreage and yield potential for soybeans as December and January meal futures rambled four percent higher. December soybean meal futures gained $13.30 per ton to $351.90. Soybean meal prices are $34.70 per ton over values from a month ago and $9.80 above pricing two weeks back. Price support is seen at $321 and resistance at $358. Hedge fund managers boosted net long holdings 12 percent to 72,999 last week, their most bullish position of the year.

Corn futures rallied four percent, erasing last week’s decline and pushing prices to levels not seen since early March. September stocks were seen by the USDA at 2 billion bushels, down 10 percent from September of 2019. Exports for corn exceeded expectations last week. Lower corn stocks and strong export demand helped to buoy values. Price support is seen at $3.62 versus resistance at $3.83. Ethanol production continued to pull back, falling 25 thousand barrels per day to 881, a 15-week low. Economic concerns and planned maintenance have recently slowed output. Corn futures are 22 cents per bushel above values from a month ago and a penny per bushel over prices from two weeks back. Friday’s COT report showed managed money remained bullish corn, adding 10,908 contracts to their net long futures position by reducing short holdings while increasing longs. This was an 11 percent increase to the overall net long position and the longest position so far this year held by money managers.

Wheat futures gained back most of the ground lost during the prior week. Tightened ending stocks and a reduced yield outlook helped push futures five percent higher. Export demand remains robust and was slightly higher than forecast. Wheat exports are currently eight percent above last year’s pace through the same weekly period. Wheat futures are 23 cents per bushel over values from a month ago but two cents per bushel below pricing two weeks back. Price support is at $5.41 with resistance at $5.92. Hedge Funds sharply reduced short and long holdings during the past week. A larger amount of short positions was eliminated relative to long positions, leading to a 24 percent increase in net long holdings. Fund managers are now net long 18,025 contracts, up 3,482 from the week prior.