11.21.2025

Sausage casings bulletin, November 21, 2025

...

Weekly Recap

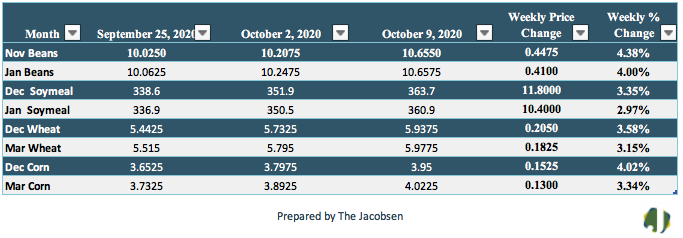

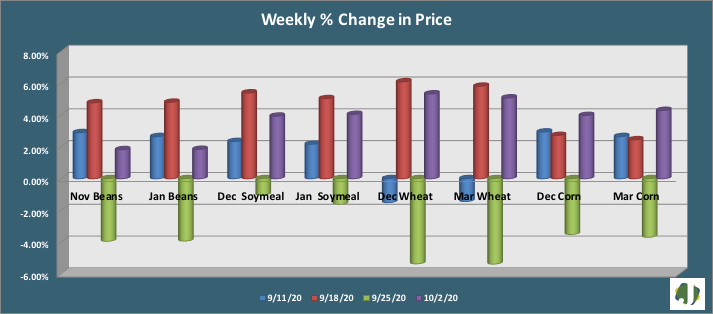

Soybean futures advanced four percent last week, adding to the prior week’s two percent gain. Harvest activity accelerated, which is bringing this season’s crop in at a pace more rapid than the historical average. Exports remain firm and were just beyond expectations. Price resistance is seen at $10.59 versus support at $9.85 for the November futures contract. Friday’s close was $0.69 per bushel above values from a month ago and 63 cents over pricing two weeks back. The latest Commitment of Traders (COT) report showed managed money remained bullish, adding to long positions and reducing shorts in the futures market. Net long holdings climbed four percent to 238,394 contracts.

Soybean meal futures extended their rally to two weeks as December and January meal futures gained three percent. December soybean meal futures were $11.80 per ton higher, closing the week at $363.70. Soybean meal prices are $39.10 per ton over values from a month ago and $25.10 above pricing two weeks back. Price support is seen at $341 and resistance at $374. Hedge fund managers added to long positions while trimming shorts. Net long holdings advanced six percent to 77,067 last week, their most bullish position of the year.

Corn futures advanced four percent, matching last week’s rise and pushing prices to levels not seen since October 2019. Corn exports were within expectations but remain very strong and well above last season’s export pace. Price support is seen at $3.83 versus resistance at $3.99. Ethanol production advance nearly five percent, increasing to 923 thousand barrels per day. This was the first weekly rise in four weeks. Corn futures are 27 cents per bushel above values from a month ago and 30 cents per bushel over prices from two weeks back. Friday’s COT report showed managed money remained bullish corn, adding 27,646 contracts to their net long futures position by reducing short holdings while increasing longs. This was an 26 percent increase to the overall net long position and the longest position so far this year held by money managers.

Wheat moved higher on a weekly basis for a second straight week. Tightened ending stocks and a dry planting conditions in the Southern Plains helped push futures 3.6 percent higher. Export demand remains solid and eight percent over last season’s export pace. Wheat futures are 52 cents per bushel over values from a month ago and 50 cents per bushel over pricing two weeks back. The last time wheat futures closed at current levels was back in 2015. Price support is at $5.78 with resistance at $6.17. Hedge Funds continued to reduce short holdings while adding to longs. Money managers net long holdings increased 52 percent to 27,379.