Weekly Recap

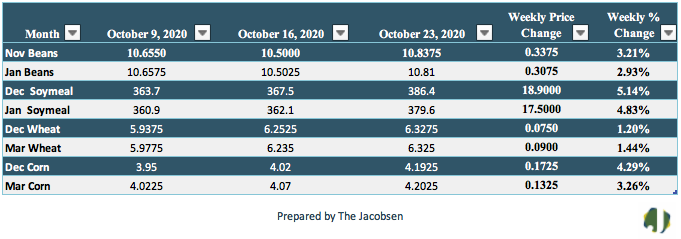

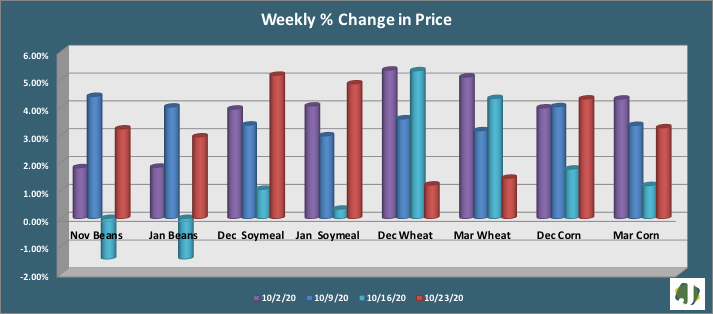

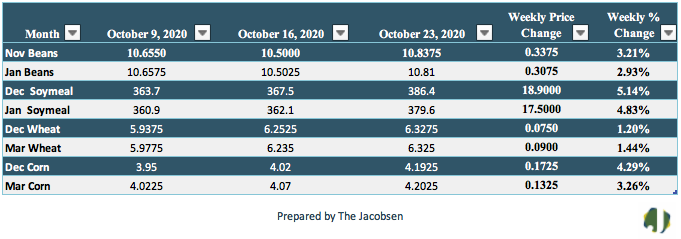

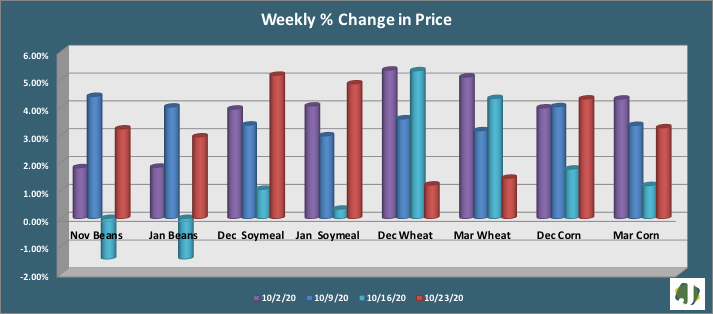

Soybean futures rebounded from the prior week’s decline, climbing three percent and closing at highs not seen since 2016. More than 75 percent of the crop has been harvested, which is well above the historical average. Exports remain firm and at the higher end, or above, analyst expectations. Current export activity is handily outpacing last season. Price resistance is seen at $10.92 versus support at $10.57 for the November futures contract. Friday’s close was $0.81 per bushel above values from a month ago and 18 cents over pricing two weeks back. The latest Commitment of Traders (COT) report showed managed money reducing short exposure while holding steady with their long positions. Net long holdings climbed two percent to 231,892 contracts.

Soybean meal futures continued to move higher with prices advancing for a fourth consecutive week. December soybean meal futures climbed $18.90 per ton, closing the week at $386.40. Soybean meal prices are $47.80 per ton over values from a month ago and $22.70 above pricing two weeks back. Price support is seen at $374 and resistance at $392. Soybean meal prices are currently testing two-year highs. Hedge fund managers remain bullish. Net long holdings advanced six percent to 81,624 last week, their most bullish position of the year.

Corn futures gained two percent on a weekly basis, marking the fourth straight week of price appreciation and elevating prices to levels not seen since August of 2019. Corn exports exceeded analyst expectations last week and are running well above last season’s export pace. Price support is seen at $3.99 versus resistance at $4.25. Ethanol production declined 2.6 percent to 913 thousand barrels per day. Reduced ethanol production and increased commodity demand is likely to pressure DDGS prices higher. Corn futures are 54 cents per bushel above values from a month ago and 24 cents per bushel over prices from two weeks back. Friday’s COT report showed managed continued to be bullish corn, adding 32,680 contracts to their net long futures position while reducing short holdings by 15,276. This increased net long holdings 28 percent to 218,825.

Wheat prices moved higher on a weekly basis for the fourth straight week. Wheat closed the week at its highest level since 2014. Export demand remains solid and 9.5 percent over last season’s export pace. Prices may see some softening with improving conditions in soil moisture allowing concerns about yields to lessen. Rains in Russia alleviated some soil concern there, while rain and snow in the southern plains will help soil conditions in the US. Wheat Midd pricing has been rising with the commodity price squeeze. Wheat futures are 89 cents per bushel over values from a month ago and 39 cents per bushel over pricing two weeks back. Price support is at $6.17 with resistance at $6.35. Hedge Funds added 11,978 long contracts to net holdings, which pushed the overall net long position 29 percent higher to 49,728.