11.21.2025

Sausage casings bulletin, November 21, 2025

...

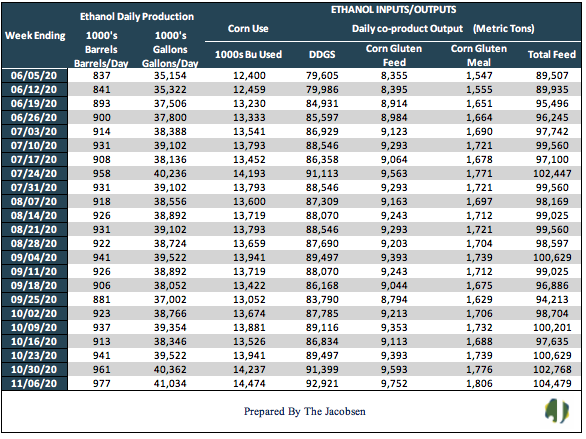

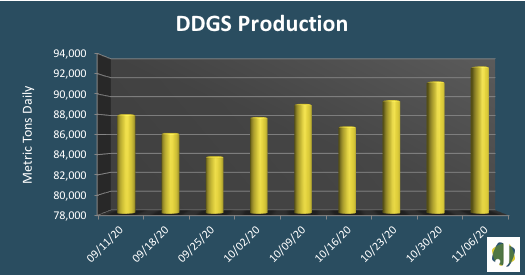

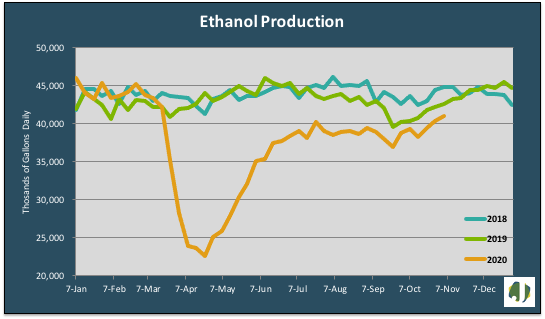

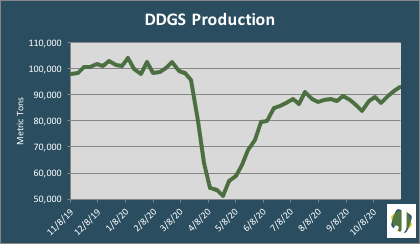

Ethanol production advanced 16,000 barrels per day to a 977 million-barrel-per-day average during the week ending November 6, 2020. Ethanol and DDGS volumes reached another post-pandemic high for output, recording levels not seen since the week the pandemic was announced. Ethanol production was 1.7 percent above last week’s output but 5.2 percent below levels seen at this time last year. DDGS output increased by 1,522 metric tons per day but was 5,041 MT below daily production a year ago.

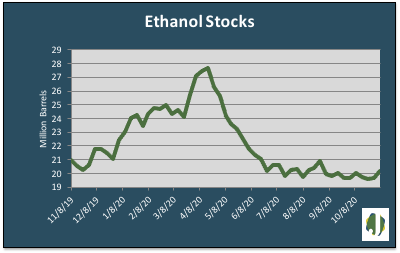

Gasoline supply increased 5.1 percent but was six percent below 2019 levels for the same period. Ethanol stocks increased to 20.2 million barrels, reaching a 10-week high. There were 20 million gallons of sugarcane ethanol imported to the West Coast during the week ending November 6. This was the largest weekly import total recorded by the Energy Information Administration (EIA) since September of 2019 Increased ethanol output raised corn demand 237 thousand bushels per day. DDGS output moved with ethanol production, increasing 1.7 percent for the week.

Ethanol 2020 output is averaging 898,630 b/d per week, up 1,741 barrels daily from last week but 129,908 barrels below 2019 average weekly production. The ethanol blend rate declined to 11.2 percent. Average year to date gasoline demand is 50.4 million gallons per day below 2019 average demand.

Approximately 14.5 million bushels of corn were consumed daily in the production of ethanol and, as a co-product of production, 104,118 metric tons of livestock feed was produced daily. DDGS production accounted for 92,921 metric tons, with the balance comprised of 9,572 MT of corn gluten feed and 1,625 MT of corn gluten meal.

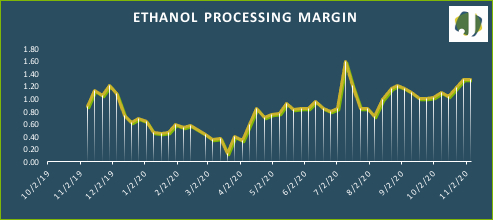

The estimated ethanol-processing margin was unchanged as declining ethanol and DDGS pricing matched reduced corn cost. Revenue from ethanol and DDGS sales declined from $5.96 to $5.89 per bushel while the cost of corn fell seven cents to $3.99 per bushel. This left the margin unchanged at $1.31 per bushel. The estimated margin is 48 percent above the value seen a year ago.