06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

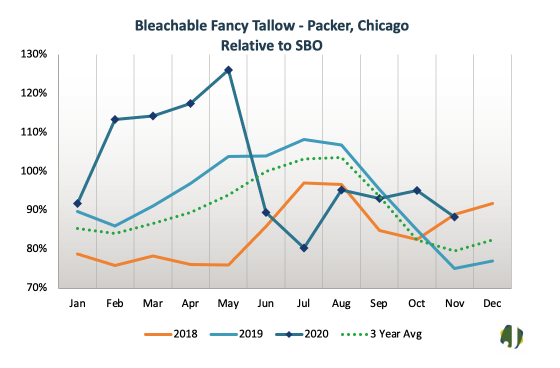

The week closed on a mostly quiet note, with trading primarily quiet in the spot market. UCO did trade higher into the Gulf market. BFT has moved along at steady prices through the month, with buyers and sellers seemingly well balanced at the moment. There have been reports of a push for higher prices on packer material in some markets, pockets of heavier spot supply in others, but Chicago trading has been steady. The relative price to soybean oil for the month is at 88 percent, 8.5 points over the prior three-year average for November. Historically, tighter supply and inventory rebuilding for January have pushed prices higher in December. There is some risk for that pattern to play out again, but more tied to holiday production interruptions and inventory security rather than rebuilding. Until palm stearin becomes competitive with BFT there aren’t a lot of options for the traditional demand sectors and palm prices are currently trading at a 6 – 9 cent premium to BFT into the Gulf market.

Figure 1.

Broiler-fryer slaughter under federal inspection for 20-Nov-20 and 21-Nov-20 is estimated to be 32,557,000 head down 2.97 percent from a week ago and up 2.2 percent from a year ago. (Last week 33,554,000, last year 31,842,000)

Weekly broiler-fryer slaughter under federal inspection for the week ending 21-Nov-20 is estimated to be 164,867,000 head down 1.13 percent from a week ago, and up 0.02 percent from a year ago. (Last week 166,758,000, last year 164,828,000)

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...