Corn, Soybeans, & Wheat Export Pace Well Beyond Last Year’s

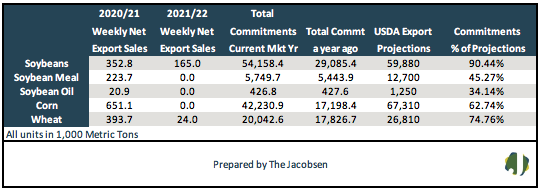

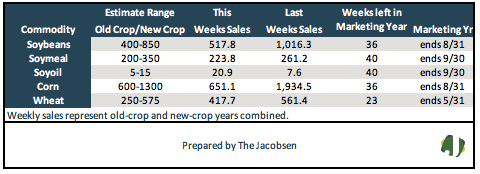

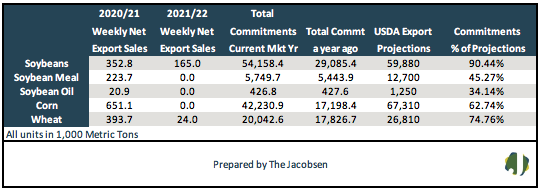

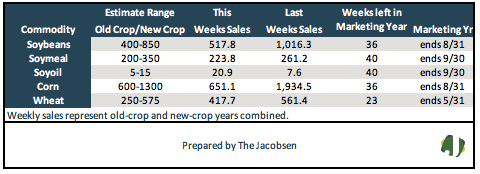

Weekly soybean export sales for the 2020/21 marketing year of 352.8 thousand metric tons (TMT), a marketing year low, were 569.5 TMT below last week’s total and 47 percent under the four-week average of 661 TMT. There were 165 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 517.8 TMT. Combined crop year sales were 49 percent below last week’s total but within analyst estimates that ranged from 400 to 850 TMT. 2020/21 export commitments are 90 percent of the USDA forecast. Export sales are 86 percent above the 2019/20 crop year pace. Major purchases were reported for the Netherlands, China, and Egypt.

Soybean meal sales for the 2020/21 marketing year of 223.7 TMT were 38 TMT under last week but 23 percent over the prior four-week average of 182 TMT. There were 40 metric tons in sales recorded for the 2021/22 crop season, lifting total sales to 223.8 TMT. Combined crop year sales were 14 percent below last week’s report but within analyst expectations that ranged from 200 to 350 TMT. Accumulated export commitments are 45 percent of forecast. Sales are six percent above last season’s pace. Major purchases were made by the Philippines, Guatemala, and Canada.

Soybean oil 2020/21 export sales of 20.9 TMT were 13.3 TMT over last week’s volume and 86 percent above the four-week average of 11 TMT. No sales were recorded for the 2021/22 crop season, leaving total sales to 20.9 TMT. Combined season sales exceeded analyst expectations that ranged from 5 to 15 TMT. 2020/21 marketing year commitments are 34 percent of forecast and need to average 21 TMT per week to meet projections. Soybean oil sales are on par with last season’s pace. Major purchases were made by Peru, Venezuela, and South Korea.

Weekly corn export sales for the 2020/21 marketing year of 651.1 TMT, a marketing year low, were 1,273 TMT below last week and 59 percent under the prior four-week average of 1,581 TMT. No sales were recorded for the 2021/22 crop season, leaving total sales to 651.1 TMT Combined sales were 66 percent below last week but within analyst expectations that ranged from 600 to 1,300 TMT. Increases were reported for Guatemala, Japan, and Egypt. 2020/21 export commitments are 63 percent of the USDA’s latest revised forecast. Export sales this season are 146 percent over the 2019/20 pace.

Wheat export sales for the 2020/21 marketing year of 393,700 metric tons, were 147 TMT below last week’s volume and 34 percent under the prior four-week average. There were 24 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 417.7 TMT. Combined sales were 26 percent below last week’s but within analyst expectations that ranged from 250 to 575 TMT. Export commitments are 75 percent of the 2020/21 USDA forecast and need to average 294 TMT per week to meet projections. Sales are 12 percent above last year’s pace. Major purchases were made by Nigeria, Mexico, and Indonesia.