11.21.2025

Sausage casings bulletin, November 21, 2025

...

The US hide market is moving along sluggishly as many overseas tanners are now closed for the holiday. Some sellers have had a few bids at lower than previous trading levels, but so far minimal trading has happening at mid-week. Today, Branded Steers (BRS) and Colorado Branded Steers (CBS) dropped $1-$2 on packer and processor material. Currently, BRS and CBS are in low demand, Butt Branded Steers are facing pressure and Heavy Native Steers continue firm.

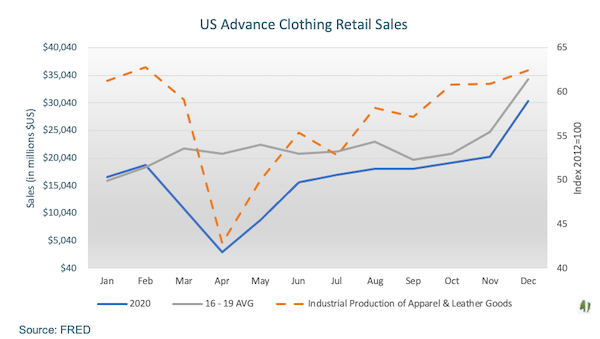

Federal Reserve Economic Data (FRED) released December figures for advance retail sales of clothing, reporting a jump to $30.4 billion, down 12 percent from the prior three-year average for December. End-of-year holiday shopping typically brings a great deal of sales for apparel, which was upheld despite the pandemic. Industrial production of apparel and leather goods also saw growth in December of 62.5 points, falling just 3 percent short of the prior three-year average for December.

In entering the new year, there is a risk to sustaining this growth in apparel sales and production due to the challenges at hand. With the lack of container availability due to the second COVID-19 outbreak in the APAC region, importers and exporters worldwide are facing a slowdown in manufacturing of goods as getting raw material in and finished goods out remains a challenge. The US Department of Commerce’s Office of Textiles and Apparel (OTEXA) released 2020 US apparel import data reporting total year shipments from China down 23.6 percent compared to 2019. These disruptions have continued and have worsened for the apparel industry into 2021 and causing distress in the hide and leather market. Despite the great demand for hide tanning, many are unable to receive their product in a timely manner. If the shipping backup continues without improvement, it is possible to see stagnant or falling sales figures in the near-term due to inability to sufficiently supply retailers.

Figure 1.

HTS 70 MIN @ $30.00

BS 62/64 @ $25.00

BS 70 MIN @ $26.00

BBS 64 MIN @ $36.00 OR 0.4400

BBS 68 MIN @ $36.00 OR 0.4125

BBS 70 MIN @ $37.00 OR 0.4125

CBS 64 MIN @ $23.50 OR 0.2875

CBS 68 MIN @ $25.00 OR 0.2875

CBS 70 MIN @ $27.00 OR 0.3000

HTS 70 MIN @ $24.50

BS 62/64 @ $22.50

BBS 62/64 @ $26.50 OR 0.3275

BBS 66/68 @ $27.00 OR 0.3150

BBS 70 MIN @ $30.00 OR 0.3350

CBS 62/64 @ $17.50 OR 0.2175

CBS 66/68 @ $18.50 OR 0.2150

CBS 70 MIN @ $20.00 OR 0.2225