11.21.2025

Sausage casings bulletin, November 21, 2025

...

The March World Agriculture Supply and Demand Estimates (WASDE) released by the USDA were unchanged for corn, soybeans, and wheat. This is somewhat good news for corn and soybeans, whose stock to use ratio had been trending lower over the past several months. For soybeans, the ratio has declined from 6.4 percent last October to 2.6 percent. Corn is down from 11.5 percent in December to 10.3 percent. A declining ratio tends to lead to an increased probability of higher prices. One thing a low ratio almost always causes is increased volatility within the market.

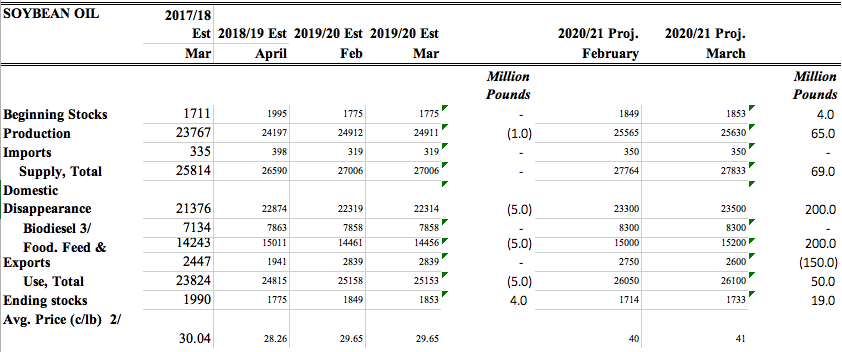

There were very few changes made by USDA on the grain balance sheets for March. Soybean oil saw the most, with production increasing 69 million pounds. Soybean oil exports were reduced 150 million pounds while food and feed use was projected 200 million pounds higher. This resulted in soybean oil ending stocks climbing 19 million to 1.73 billion pounds.

Global oilseed supply and demand forecasts include higher production, exports, and ending stocks. Soybean production in Brazil was raised 1 million tons while Argentina’s production was forecast 500K tons lower.

Market analysts were anxious to see if corn and soybean exports would increase compared to the February report. The USDA’s export forecast held steady at 2.6 billion for corn and 2.25 billion bushels for soybeans. There were expectations the March report would show an increase in export activity, as soybean exports are already at 98 percent of the USDA projections and corn is 90 percent. The market will expect the April export forecast to be adjusted higher, which could further reduce the stock to use ratio.

The Prospective Plantings Report and Quarterly Grain Stocks Report are to be released at the end of the month. It is highly anticipated the report will show an increase in planted acres. Corn acreage could increase to 90 to 92 million acres, soybeans are expected to be about 89 million, and wheat may settle at 47 million.