06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

Hide demand is increasingly getting stronger from many sectors of the market. Steers, heifers, and some cow selections saw prices increases today of $1 to a maximum of $3. Many suppliers have been able to raise asking prices due to the willingness to buy.

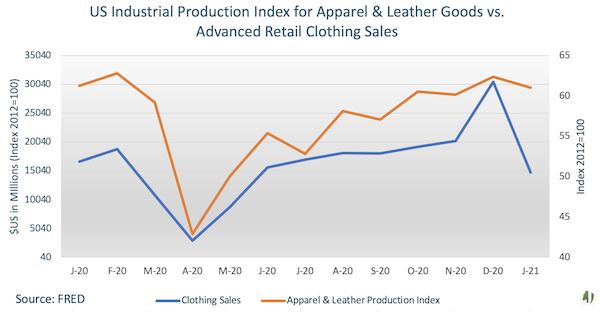

January’s Federal Reserve Economic Data (FRED) advance retail clothing sales were reported at $14.7 billion, down 52 percent from the previous month. This year’s month-over-month change was slim compared to the prior five-year December to January average drop of 109 percent. Demand for clothing continues to be high relative to the trough seen during the peak of the COVID shutdowns. However, there is downside risk building due to the lack of shipping containers and rise in freight rates from the APAC region. Leather processing complications continue due to issues getting material out of the ports and into the processing centers. Currently, hide demand is very strong as tanneries try to keep up with the strong demand for finished leather, but shipping uncertainties continue to undermine the market. Buyers are hedging the risk of shortages by purchasing additional inventory, which is causing a boost in prices. Branded Heifers are now trading at a high of $22, which is a rise of 22 percent from four weeks ago. If demand from leather customers remain high and buyers are able to receive a sufficient quantity of shipment, it is reasonable to see hide prices continue to move upwards in the near-term. However, if shipping issues get worse it is possible see a change in direction for the US hide market as inventory builds within the US and sellers are forced to discount material to move in non-traditional directions.

Figure 1.

BS 62/64 @ $27.00

BS 70 MIN @ $28.00

HBH 51/53 @ $22.00 OR 0.3300

NHNDC 51/53 @ $27.00 OR 0.4050

SHNDC 51/53 @ $26.00 OR 0.3900

NBC 51/53 @ $17.00 OR 0.2550

SBC 51/53 @ $16.00 OR 0.2400

KIP 28/32 @ $18.00

SM PKR 60 MIN @ $10.00

BS 62/64 @ $24.00

HBH 51/53 @ $14.50 OR 0.2175

NHNDC 51/53 @ $21.00 OR 0.3150

SHNDC 51/53 @ $20.50 OR 0.3075

NBC 51/53 @ $11.50 OR 0.1725

SBC 51/53 @ $10.50 OR 0.1575

KIP 28/32 @ $7.00 OR 0.1825

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...