06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

Sellers are seeing a decent volume of inquiries on bull, cow and dairy steer material. Production out of the upholstery tanneries in the Hebei province has slowed because of water shortages. Tanneries in this province were running at full capacity prior to the shortage. Demand from Hebei has been a big part of the recent rally in cow hide prices. If production interruptions continue, there is risk tanning may slow in this region.

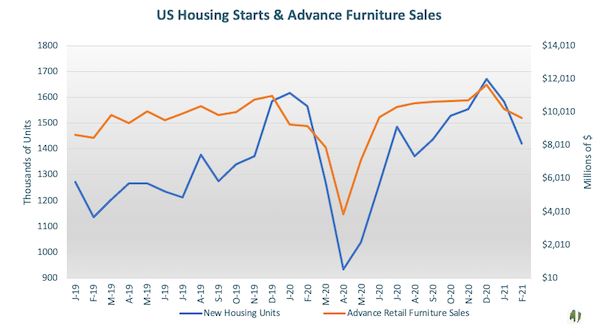

February’s Federal Reserve Economic Data for US home starts and advanced retail furniture sales were reported at their second consecutive monthly decline from December’s high-home starts were recorded down 15 percent at 1.4 million units and furniture sales were down 17 percent at $9.7 billion. Driven by low mortgage rates, home buyers took the opportunity to buy in the second half of 2020. By December, the 30-year fixed mortgage rates reached an all-time low of 2.67 percent and new housing units reached 1.7 million. In correlation, furniture sales soared to their all-time high of $11.6 billion in December. With unwavering demand, supply has shrunk putting a damper on both markets. Despite the continuing historically low mortgage rates, the insufficient supply had been unable to satisfy demand. Upholstery hide tanners are actively buying material in large volume at the higher price levels. Northern Heavy Native Dairy Cows are trading at an average of $29.50, up a staggering $20 from the year prior. The recent declining sales have not deterred demand from upholstery tanners for hides. An increase in home starts would contribute to increased hide demand for leather furniture. However, shipping container availability and port congestion pose a risk to the price rally.

Figure 1.

N Bull 100/110 @ $18.50 OR 0.1750

B Bull 100/110 @ $16.50 OR 0.1575

SM PKR 60 MIN @ $15.00

N Bull 100/110 @ $14.50 OR 0.1375

B Bull 100/110 @ $12.50 OR 0.1200

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...