04.23.2024

Rising BOHO spread spurs RIN values higher

Despite the move higher, D4 RINs are down 2% in value from the previous week. RIN prices are receiving support from the rising bean oil/heating oil (BOHO) spread, which...

The hide market began the week with Native and Branded Cow trading $1-$2 higher on packer material. Early indications are for limited sales volumes thsi week due to the announcement by a few large Chinese tanners that they will stop buying in the upcoming weeks. Additionally, the hide market is entering a period where sales have historially decreases. Reports have US sellers well sold heading into the spring.

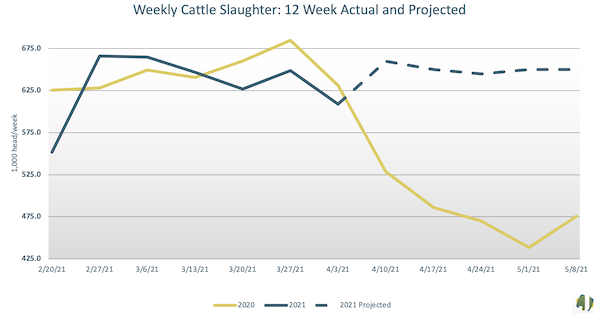

The Jacobsen slaughter forecast for this week is 609,000 head, and if realized, will be 22,300 head less than the same week last year when it was 631,300.

Cattle slaughter finished last week 649,000 head, down 5 percent from a year ago. Over the next six weeks, slaughter is forecasted at an average of 644,000 head, up an average of 2 percent from the prior six weeks and up 28 percent compared to last year.

Figure 1.

…