11.21.2025

Sausage casings bulletin, November 21, 2025

...

Low soybean stocks and heightened demand from the biofuels sector, along with limited refining capacity has created a volatile soybean and soybean oil market. The stocks to use ratio for soybeans has fallen to 2.6 percent. This is the lowest stocks to use ratio since 2013 and to put it in perspective, last year the ratio was about 13 percent. Tightening supplies lead to an increased probability for higher prices while at the same time increasing volatility within the marketplace. Soybean prices closed 36 cents per bushel higher at 15.33¼ for May Delivery, while soybean oil prices climbed 2.33 cents per pound to 62.52 cents for May delivery.

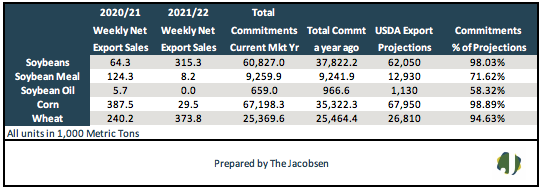

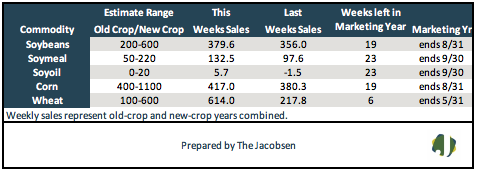

Weekly soybean export sales for the 2020/21 marketing year of 64.3 thousand metric tons (TMT) were 29 percent below last week’s total but 25 percent over the four-week average of 51.4 TMT. There were 315.3 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 379.6 TMT. Combined crop year sales were seven percent over last week’s total but within analyst estimates that ranged from 200 to 600 TMT. 2020/21 export commitments are 98 percent of the revised USDA forecast with 19 weeks remaining in the current crop season. Export sales are 61 percent above the 2019/20 crop year pace. Major purchases were reported for Japan, Bangladesh, and Indonesia.

Soybean meal sales for the 2020/21 marketing year of 124.3 TMT were 74 percent above last week but two percent under the prior four-week average of 127 TMT. There were 8.2 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 132.5 TMT. Combined crop year sales are 36 percent over last week’s report but within analyst expectations that ranged from 50 to 220 TMT. Accumulated export commitments are 72 percent of forecast. Sales are on par with last season’s pace. Major purchases were made by Mexico, Nicaragua, and Ecuador..

Soybean oil 2020/21 export sales of 5.7 TMT were 7.1 TMT over last week’s report but 28 percent below the prior four-week average of 7.9 TMT. No sales were recorded for the 2021/22 crop season, leaving total sales at 5.7 TMT. Combined season sales were within analyst expectations that ranged from 0 to 20 TMT. 2020/21 marketing year commitments are 58 percent of forecast and need to average 20 TMT per week to meet projections. Soybean oil sales are 32 percent below last season’s pace. Major purchases were made by Jamaica and the Dominican Republic, and Canada.

Weekly corn export sales for the 2020/21 marketing year of 387.5 TMT were 18 percent above last week’s sales but 75 percent below the prior four-week average of 1,576 TMT. There were 29.5 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 417 TMT. Combined sales were 10 percent over last week’s sales total and within analyst expectations that ranged from 400 to 1,100 TMT. Increases were reported for China, South Korea, and Mexico. 2020/21 export commitments are 99 percent of the USDA’s revised forecast with 19 weeks remaining in the current crop season. Export sales this season are 90 percent above the 2019/20 pace.

Wheat export sales for the 2020/21 marketing year of 240,200 metric tons were 296.8 TMT over last week’s volume and 55 percent above the prior four-week average. There were 373.8 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 614 TMT. Combined season sales were 182 percent above last week’s total and exceeded analyst expectations that ranged from 100 to 600 TMT. Export commitments are 95 percent of the 2020/21 USDA forecast and need to average 240 TMT per week to meet projections. Sales are on par with last year’s pace. Major purchases were made by Mexico, Taiwan, and Japan.