11.21.2025

Sausage casings bulletin, November 21, 2025

...

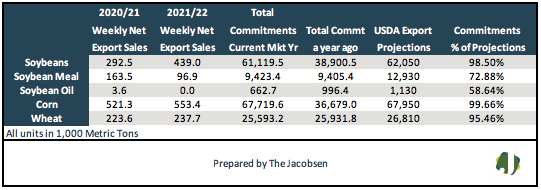

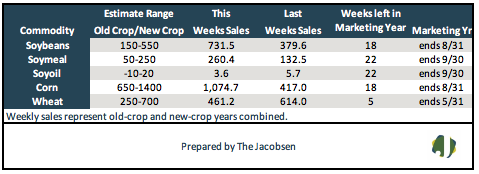

Weekly soybean export sales for the 2020/21 marketing year of 292.5 thousand metric tons (TMT) were noticeably above last week’s total and the four-week average of 42 TMT. There were 315.3 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 731.5 TMT. Combined crop year sales were 93 percent over last week and exceeded analyst estimates that ranged from 150 to 550 TMT. 2020/21 export commitments are 98.5 percent of the revised USDA forecast with 18 weeks remaining in the current crop season. Export sales are 61 percent above the 2019/20 crop year pace. Major purchases were reported for Mexico, China, and Egypt.

Soybean meal sales for the 2020/21 marketing year of 163.5 TMT were 32 percent over last week and 41 percent above the prior four-week average of 116 TMT. There were 96.9 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 260.4 TMT. Combined crop year sales are 96 percent above last week’s report and exceeded analyst expectations that ranged from 50 to 250 TMT. Accumulated export commitments are 73 percent of forecast. Sales are on par with last season’s pace. Major purchases were made by the Philippines, the Dominican Republic, and Canada.

Soybean oil 2020/21 export sales of 3.6 TMT were 36 percent below last week’s report and 39 percent below the prior four-week average of 6 TMT. No sales were recorded for the 2021/22 crop season, leaving total sales at 3.6 TMT. Combined season sales were within analyst expectations that ranged from -10 to 20 TMT. 2020/21 marketing year commitments are 59 percent of forecast and need to average 21 TMT per week to meet projections. Soybean oil sales are 33 percent below last season’s pace. Major purchases were made by Canada, Venezuela, and El Salvador.

Weekly corn export sales for the 2020/21 marketing year of 521.3 TMT were 35 percent over last week’s but eight percent under the prior four-week average of 567 TMT. There were 553.4 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 1,074.7 TMT. Combined sales were 158 percent over last week but within analyst expectations that ranged from 650 to 1,400 TMT. Increases were reported for Saudi Arabia, South Korea, and Mexico. 2020/21 export commitments are 93 percent of the USDA’s revised forecast with 20 weeks remaining in the current crop season. Export sales this season are 98 percent above the 2019/20 pace.

Wheat export sales for the 2020/21 marketing year of 223,600 metric tons were seven percent below last week’s volume but 73 percent over the prior four-week average. There were 237.7 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 461.2 TMT. Combined season sales were 25 percent below last week’s total but within analyst expectations that ranged from 250 to 700 TMT. Export commitments are 95 percent of the 2020/21 USDA forecast and need to average 243 TMT per week to meet projections. Sales are on par with last year’s pace. Major purchases were made by Mexico, Indonesia, and Yemen.