11.21.2025

Sausage casings bulletin, November 21, 2025

...

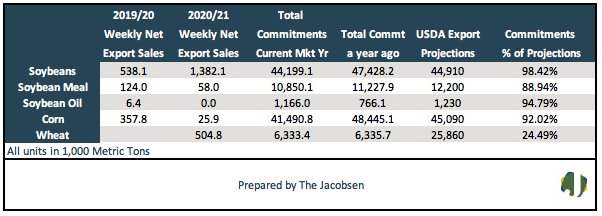

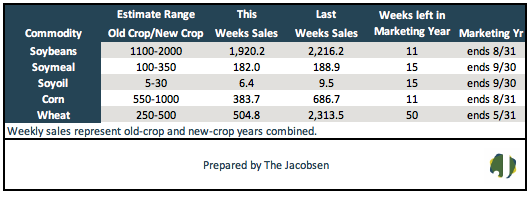

Soybean export sales for the 2019/20 marketing year of 538.1 thousand metric tons (TMT), were 465.6 TMT below last week’s total and 36 percent under the four-week average of 837 TMT. New crop sales totaled 1,382.1 TMT, lifting total sales to 1,920.2 TMT. Combined crop year sales were 13 percent below last week’s but within analyst estimates that ranged from 1,100 to 2,000 TMT. 2019/20 export commitments are 98 percent of the USDA revised forecast and need to average 65 TMT per week to meet expectations. Export sales are seven percent below the 2018/19 crop year pace. Major purchases were reported for China, Taiwan, and Egypt.

Soybean meal sales for the 2019/20 marketing year of 124 TMT were 83.9 TMT below last week’s total and 54 percent under the prior four-week average of 272 TMT. New crop sales were 58 TMT, lifting total sales to 182 TMT. Combined crop year sales were four percent below last week’s report but within analyst expectations that ranged from 100 to 350 TMT. Accumulated export commitments are 89 percent of forecast and need to average 90 TMT per week to meet projections. Sales are four percent below last season’s pace. Major purchases were made by Morocco, Canada, and the Philippines.

Soybean oil 2019/20 export sales of 6,400 metric tons was 3.1 TMT below last week’s volume and 81 percent below the four-week average of 34.4 TMT. There were no new crop sales, leaving total sales at 6.4 TMT. Combined season sales were within analyst expectations that ranged from 5 to 30 TMT. 2019/20 marketing year commitments are 95 percent of forecast and need to average 4.3 TMT per week to meet revised projections. Soybean oil sales are 52 percent over last season’s pace. Major purchases were made by Mexico, Columbia, and the Dominican Republic.

Weekly corn export sales for the 2019/20 marketing year of 357.8 TMT, were 302.9 TMT below last week’s total and 45 percent below the prior four-week average. New crop sales were 25.9 TMT, lifting combined season sales to 383.7 TMT. Combined sales were 44 percent below last week’s total and less than analyst expectations that ranged from 550 to 1,000 TMT. Increases were reported for Guatemala, South Korea, and Mexico. 2019/20 export commitments are 92 percent of the USDA forecast. Export sales trail last season’s pace by 14 percent.

Wheat export sales for the 2020/21 marketing year of 504,800 metric tons were noticeably below last week’s total and 42 percent below the prior four-week average. There were not any new crop sales during the week, leaving total sales at 504.8 TMT. Combined sales were 78 percent below last week’s total but exceeded analyst expectations that ranged from 250 to 500 TMT. Export commitments are 24 percent of the 2020/21 of the USDA forecast and need to average 391 TMT per week to meet projections. Sales are on par with last year’s pace. Major purchases were made by Guatemala, Sri-Lanka, and Mexico.