11.21.2025

Sausage casings bulletin, November 21, 2025

...

Weekly Recap

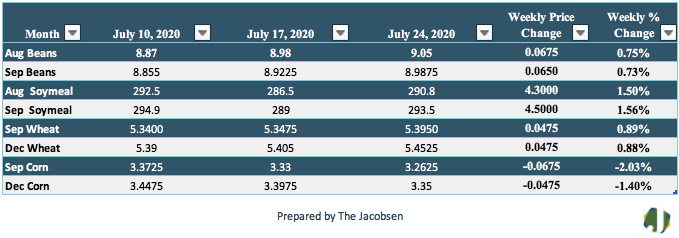

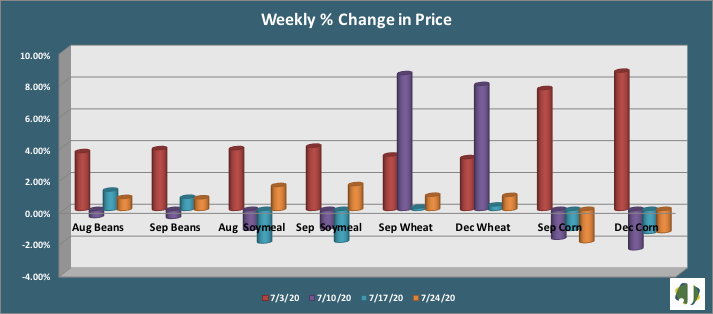

Soybean futures closed higher on a weekly price basis for the second time in three weeks and have seen higher weekly closes in seven of the past nine weekly periods. Concerns over soybean pod development in Illinois are being offset to a certain extent with recent rain. Soybean prices increased 6.75 cents per bushel for August and 6.5 cents for the September futures contract. Price resistance is seen at $9.01 versus support at $8.81. Futures prices closed the week 45 cents per bushel above values seen at this time last month and 17 cents over pricing two weeks earlier. Friday’s Commitment of Traders (COT) report showed managed money increased overall long exposure 15 percent during the week. Short positions edged 1,024 contracts higher while long positions increased 10,858, boosting the overall long position to 75,809. Prices are trading at resistance this morning.

Soybean meal futures followed soybeans, rising 1.5 percent in value for the week. Meal prices increased $4.30 to $290.80 per ton for August and $4.50 to $293.50 for Sep, reclaiming most of the price decline from the prior week. Meal prices are up $5.50 per ton over the past month but $1.70 per ton below the prior two-week period. Price support is seen at $294 with nearby resistance at $309. Hedge fund managers reduced net short holdings four percent over the past week. Long holdings increased 3,108 contracts while short positions increased 1,907. The meal market is currently net short 29,178 futures contracts.

Corn futures closed two percent below last week’s value, falling just over three cents per bushel. The decline marked the third time in as many weeks that that corn pricing fell on a weekly basis. Prices are little changed this morning, holding just over nearby support. Initial support is seen at $3.31 versus resistance at $3.55 Ethanol production declined for the first time in 12 weeks on increasing pandemic concerns. Futures prices are seven cents per bushel over values from a month ago but 11 cents below pricing two weeks back. Friday’s COT report showed managed money continues to hold a large net short position in the market. Net short holdings increased three percent to 137,770 during the week.

Wheat futures edged fractional higher, reaching their highest weekly close since April. Wheat plantings are at a historic low in the US and the USDA lowered production forecast for the EU, Russia, and the US. Global stocks remain at a record highs, alleviating some concerns over planting. Wheat prices increased 5.40 cents per bushel for the September futures contract and $5.45 cents per bushel for the Dec. Prices are up 64 cents per bushel from a month ago and five cents per bushel over values from two weeks back. Price support is at $5.18 with resistance at $5.40. Hedge Funds moved flattened out their overall market position last week, moving from a net short position of 8,327 futures contracts to being net long 474.