11.21.2025

Sausage casings bulletin, November 21, 2025

...

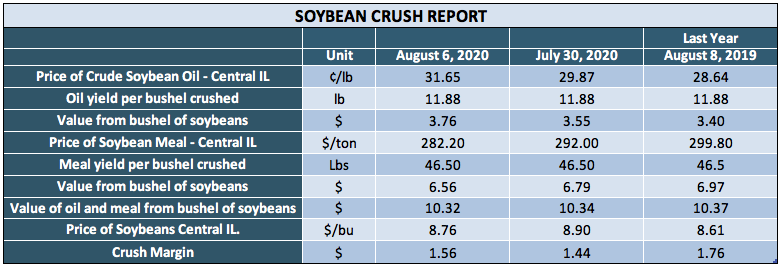

The estimated crush margin improved nine percent as the cost of soybeans declined and the price of soybean oil moved higher. Soybean meal revenue declined but not by enough to offset the moves in soybeans and soybean oil. The value received from oil and meal sales per bushel of soybeans crushed fell from $10.34 to $10.32 per bushel while the price of soybeans dropped 14 cents to $8.76 per bushel. The margin expanded 12 cents to $1.56 per bushel. Soybean prices are two percent higher than they were a year ago, oil values are up nine percent, but meal prices are down six percent from last year. The crush margin is 11 percent below levels seen August 8, 2019.

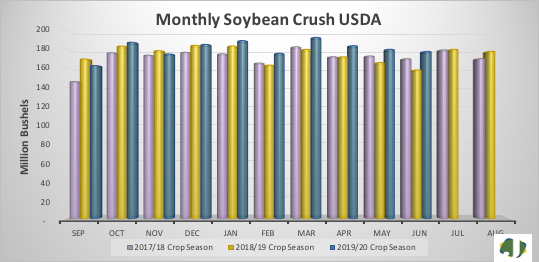

The US Department of Agriculture’s (USDA) June crush data was in line with expectations from the data previously released by the National Oilseed Processors Association (NOPA) in mid-July. Per the USDA, 177.3 million bushels of beans were crushed during June, resulting in 2.04 billion pounds of oil and 3.90 million tons of meal. The June soybean crush was 1.3 percent below the May crush total but 12.5 percent over the June 2019 crush. Crude oil output fell one percent and soybean meal production declined 1.7 percent from May.

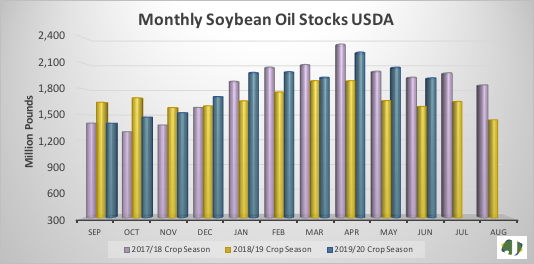

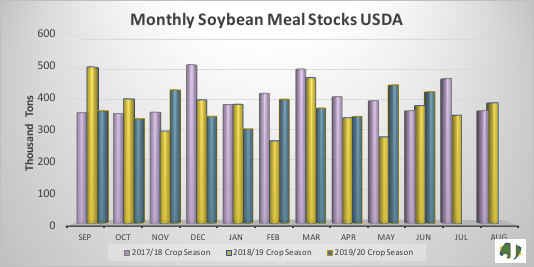

Soybean meal stocks moved from a 14-month high of 442,173 tons in May to 420,426 tons at the end of June. Soybean meal stocks declined five percent but are 12 percent above levels seen a year ago. Crude soybean oil stocks fell by six percent in June to 1.92 billion pounds, a six-month low. USDA soybean stock levels at the end of June are 21 percent higher than they were in June of 2019. Total soybean oil stocks, crude and once refined, are 2.27 billion pounds, down from 2.45 billion pounds a month ago. The USDA expects the 2019/20 crush to be 1.58 percent above the 2018/19 crush. Ten months through the current crush season, the actual crush is performing above expectations, with the current pace 4.1 over last season’s.