11.21.2025

Sausage casings bulletin, November 21, 2025

...

Weekly Recap – DDGS Prices May Benefit from Increased Ethanol Output

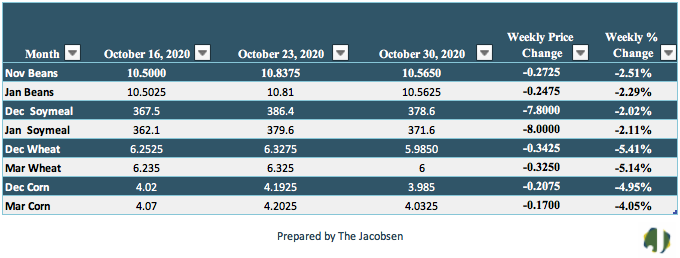

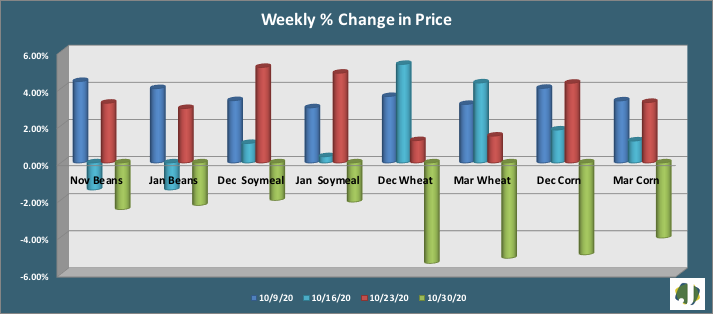

Soybean futures closed the week more than two percent lower, giving up all the gain from the prior week. Despite the decline, soybean prices remain well supported and are holding near 3-year highs. More than 72 percent of the crop has been harvested, which is above the historical average of 56 percent for this time of the year. Weekly export activity continues to be strong and is 145 percent above last year’s pace for this point in the season. Price resistance is seen at $10.58 followed by $10.92 versus support at $10.16 for the November futures contract. Friday’s close was $0.36 per bushel above values from a month ago and six cents over pricing two weeks back. The latest Commitment of Traders (COT) report showed managed money being indecisive on the market for the first time in weeks.. Net long holdings held steady this week at 232,716 contracts.

Soybean meal futures closed lower on a weekly basis for the first time in five weeks but remain well supported and trading near 3-year highs. The December soybean meal future slipped $7.80 to $378.60. Soybean meal prices are $26.70 per ton over values from a month ago and $11.10 above pricing two weeks back. Price support is seen at $374 and resistance at $392. Soybean meal prices are trading $4.00 per ton higher in early trading Monday morning Hedge fund managers remain somewhat bullish, according to the Latest COT report.. Net long holdings advanced three percent to 84,279 last week, a fresh high for the year.

Corn futures fell five percent on a weekly basis over the past week, as farmers swiftly sold into pricing that reached highs not seen in more than a year. Corn exports exceeded analyst expectations and are running nearly 170 percent above last season’s export pace. Price support is seen at $3.83 versus resistance at $3.99 followed by $4.25. Ethanol production increased three percent to 941 thousand barrels per day, reaching a 13-week high. DDGS prices could see some relief from increased ethanol production. Corn futures are 19 cents per bushel above values from a month ago but three cents per bushel below pricing from two weeks back. Friday’s COT report showed managed money remained bullish corn, adding 41,005 contracts to their net long futures position while reducing short holdings 16,405. This increased net long holdings 26 percent to 236,805.

Wheat prices moved lower on a weekly basis for the first time in five weeks, retreating more than five percent during the week. Wheat futures pulled back from highs not see since 2014 but are still trading at highs not seen since 2015. Export demand was above market expectations last week and 11 percent over last season’s export pace. Conflicting global positions and weather events continue to work their way through the wheat market. Wheat Midd pricing remains firm in the near-term and expected to hold near current levels through Q1 of 2021. Wheat futures are 25 cents per bushel over values from a month ago but 27 cents per bushel below pricing two weeks back. Price support is at $5.92 with resistance at $6.35. Hedge Funds reduced net long holdings two percent to 48,896 in the latest COT report.