11.21.2025

Sausage casings bulletin, November 21, 2025

...

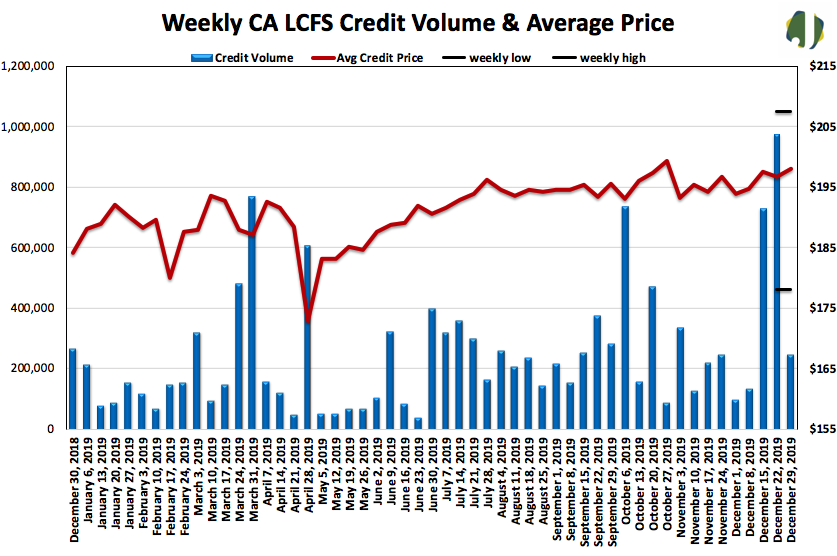

Credit volume declined during the final full week of 2019 trading. The latest trading data released by the California Air Resources Board (CARB) shows volume fell sharply after reaching an all-time high during the third week of December. Credit volume during the week ending December 29 was down 75 percent from the week prior and seven percent below the volume reported during the same weekly period a year ago. The weighted average price paid per credit increased $1.30 to $198.10 and the weekly volume was 249,120 on 26 transactions. There were six type 1 transactions for 40,800 credits and 20 type 2 transactions for 249,120 credits. Type 1 transactions are trades executed within 10 days of a transfer agreement. Type 2 transactions are executed beyond 10 days of a transfer agreement. Average 2019 weekly credit volume shifted from 248,907to 248,911. Fourth quarter volume is 39 percent over third quarter volume and eight percent over Q4 of 2018.

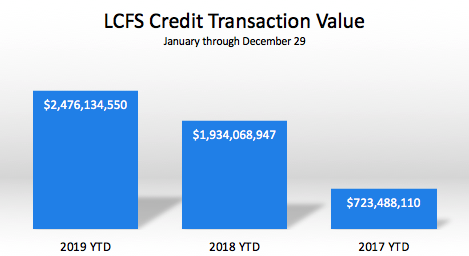

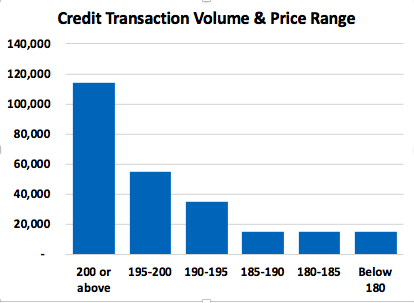

Trading volume was heaviest on Monday with 48 percent of the transacted volume taking place. The highest average daily price was $206 and occurred on Friday. The price range credits traded in expanded from to $180 – $209 to $178 – $207.50 in this week’s report. The value of the week’s credit transactions totaled $49.4 million, down from $192.5 million last week. At the top of this week’s price range, 10,000 credits traded for $207.50 and 10,000 traded for $178 at the bottom of the range. Forty-six percent of the transactions occurred at a price of $200 or higher, 36 percent of the trades happened between $190 and $199.99, and 18 percent were below $190. The value of this year’s credit transactions is 2.48 billion, which is 28 percent over last year’s total of 1.93 billion through the same weekly period. CARB proposed to place a hard cap of $200 on the LCFS credit. This proposed amendment is expected to be approved early in 2020. The $200 cap is based on 2016 dollars and is currently valued at $213.07 today.

The Jacobsen expects credit volume to exceed last year’s pace. An additional 1.755 million credits from biodiesel and renewable diesel are forecast to be generated within the California market during 2019. There were 11.18 million LCFS program credits generated during 2018 and 13.7 million forecast for 2019. Renewable diesel and biodiesel credit generation is expected to reach 6.62 million, or 48 percent of all program credits. There have been 12.91 million credits transacted so far this year.

CARB only includes transfers that are completed in the given week. Transfers for future dates, proposed and still pending confirmation, are excluded. CARB’s weekly report excluded one transfer of 924 credits. CARB will exclude transfers that trade at, or near, zero in price.