11.21.2025

Sausage casings bulletin, November 21, 2025

...

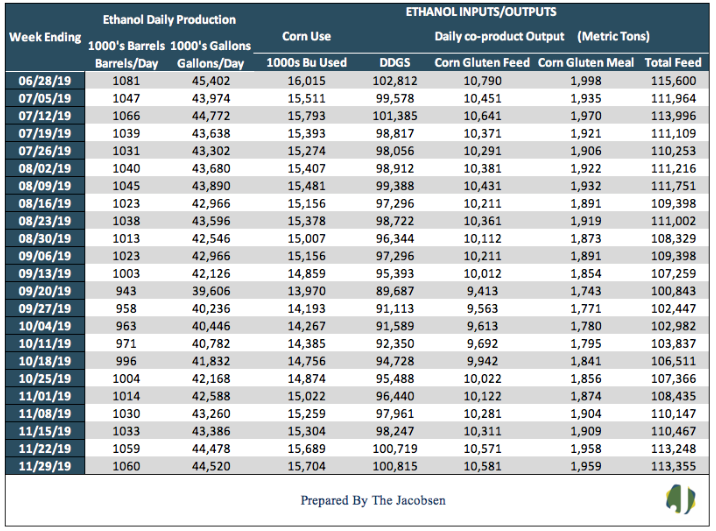

According to the EIA’s Weekly Petroleum Status Report, ethanol production Increased 1,000 barrels per day to a 1.06 billion-barrel-per-day average during the week ending November 29, 2019. DDGS output reached a 20-week high but is fractionally below levels seen at this time last year.

Gasoline demand declined to 9.03 million barrels per day. Current weekly gasoline demand is two percent above levels from a year ago. Ethanol stocks expanded for the first time in four weeks but at 20.64 million barrels they are 10 percent below levels from a year ago. Ethanol imports arrived for a third consecutive week, adding about 3.2 million gallons of supply. Sugar-cane ethanol imports have been arriving at a significantly stronger pace this year and will reach their highest level since 2013. The increase in ethanol production caused corn demand to grow by 15 thousand bushels per day. Distiller Dried Grains (DDGS_ output moved in sync with ethanol production, rising fractionally for the week.

Ethanol output is averaging 1,024,979 b/d, up 745 barrels daily from last week but 21,329 barrels below the 2018 weekly average. The industry is on pace to produce 15.71 billion gallons, slightly higher than the 2019 finalized ethanol renewable volume obligation (RVO) of 15 billion. The ethanol blend rate increased to 11.7 percent. Average year to date gasoline demand during 2019 is 976 thousand gallons per day above 2018 average demand.

Approximately 15.7 million bushels of corn were consumed daily in the production of ethanol and, as a co-product of production, 112,963 metric tons of livestock feed was produced daily. DDGS production accounted for 100,815 metric tons, with the balance comprised of 10,385 MT of corn gluten feed and 1,763 MT of corn gluten meal.

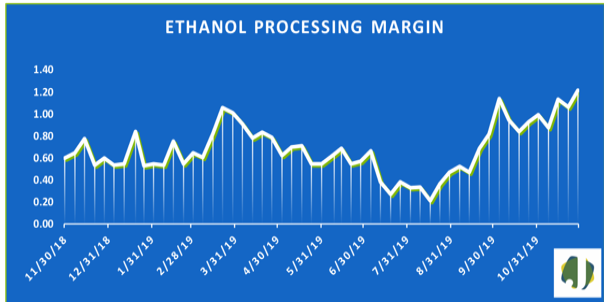

The estimated ethanol-processing margin climbed 15 percent over the past week. Revenue derived from ethanol and DDGS sales increased from $5.57 per bushel to $5.72 on stronger ethanol and DDGS pricing. Corn cost held steady at $3.91. This allowed the margin to expand 15 cents to $1.22 per bushel. The estimated margin is 102 percent over than the same weekly 2018 time frame.