11.21.2025

Sausage casings bulletin, November 21, 2025

...

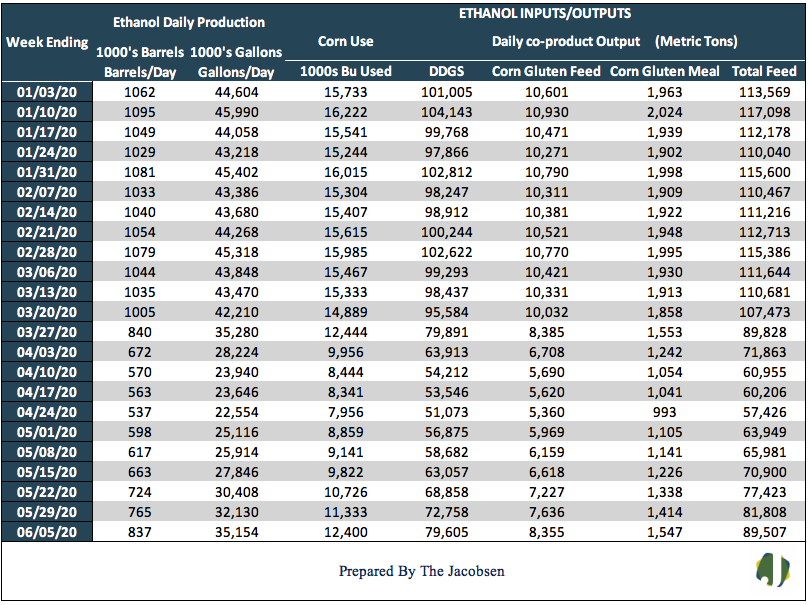

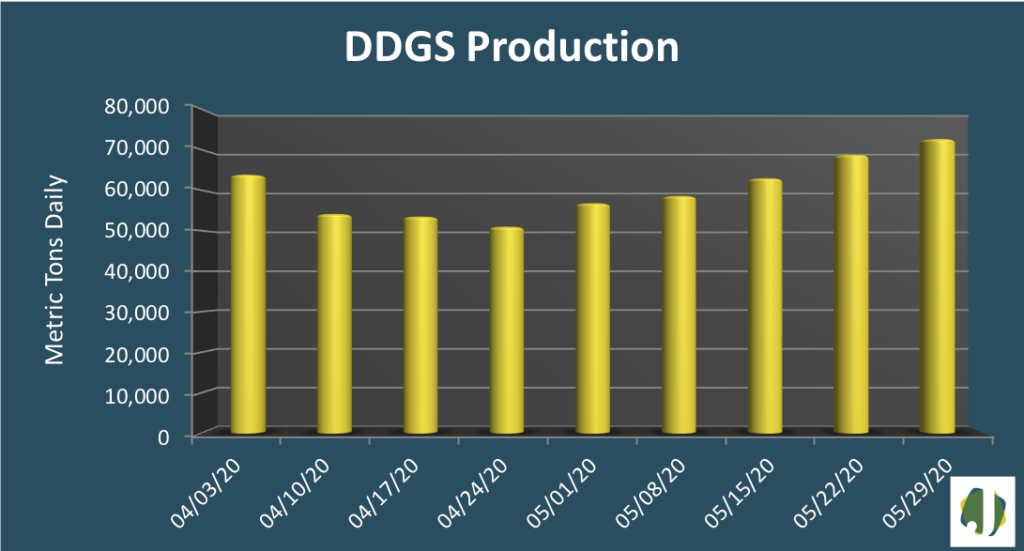

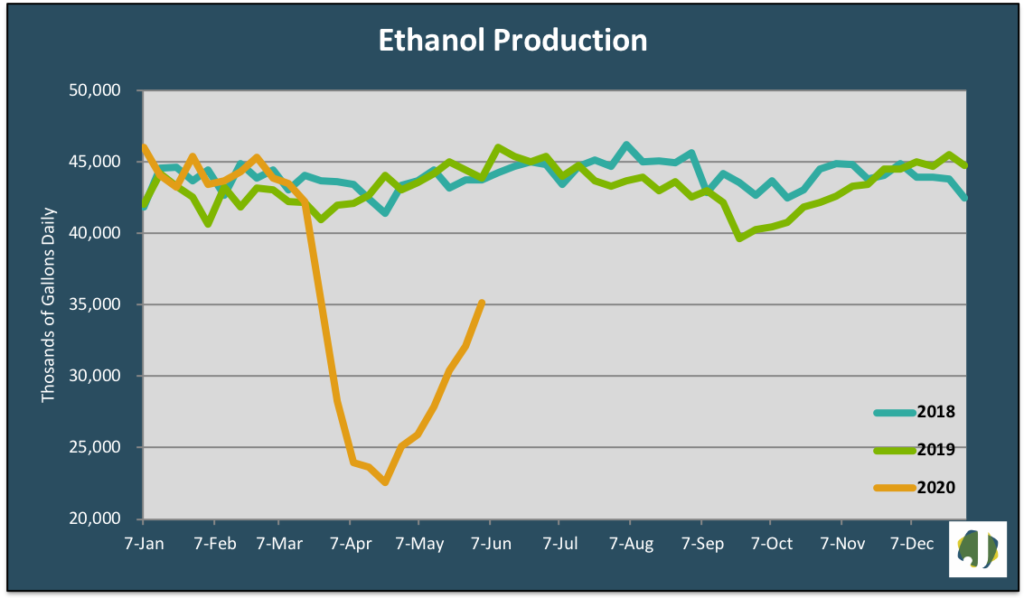

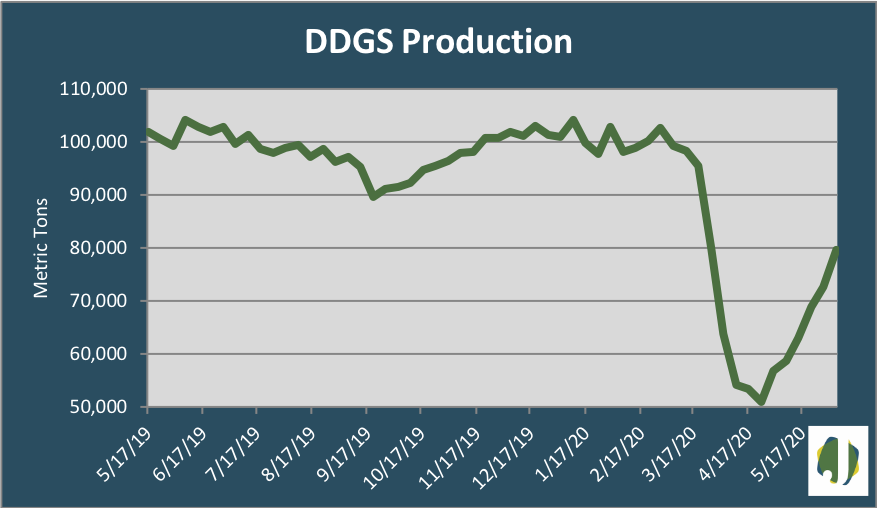

Ethanol production increased 72,000 barrels per day to an 837 million-barrel-per-day average during the week ending June 5, 2020, hitting a 10-week high, according to the EIA’s Weekly Petroleum Status Report. Output increased 9.4 percent from last week but is 24 percent below production levels at this time last year. DDGS output climbed 6,848 metric tons daily during the past week but is 27,601 MT below daily production from a year ago.

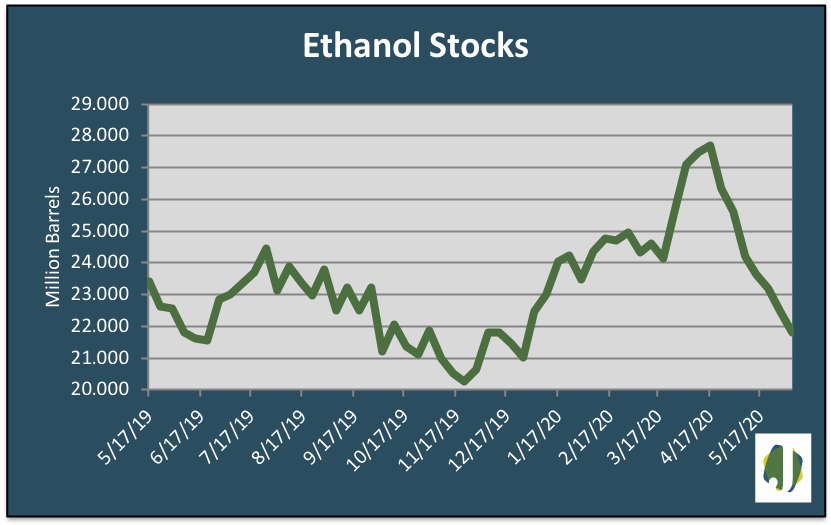

Gasoline supply increased 4.7 percent, hitting its highest level since the pandemic was announced. Gasoline supply is 20 percent below 2019 levels for the same weekly period. Ethanol stocks reached a 23-week low at 21.8 million barrels. Ethanol imports were absent again during the week. The increase in ethanol production raised corn demand by 1.1 million bushels per day. DDGS output moved with ethanol production, rising 9.4 percent for the week.

Ethanol output is averaging 877,417 b/d per week during 2020, down 1,757 barrels daily from last week and 151,122 barrels below average 2019 weekly production. The ethanol blend rate increased to 10.6 percent. Average year to date gasoline demand is 61.5 million gallons per day below 2019 average demand.

Approximately 12.4 million bushels of corn were consumed daily in the production of ethanol and, as a co-product of production, 89,198 metric tons of livestock feed was produced daily. DDGS production accounted for 79,605 metric tons, with the balance comprised of 8,200 MT of corn gluten feed and 1,392 MT of corn gluten meal.

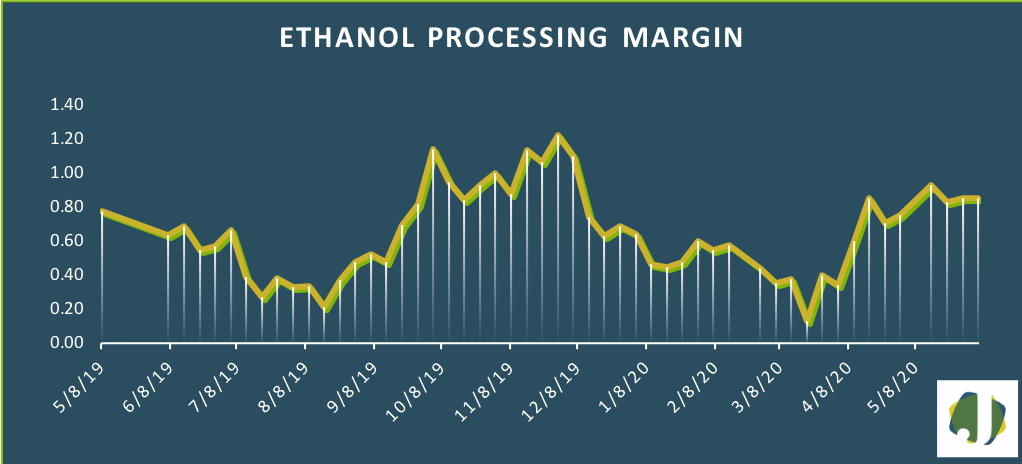

The estimated ethanol-processing margin edged higher during the week. Revenue from ethanol and DDGS sales moved from $4.66 to $4.73 per bushel while the cost of corn increased six cents to $3.28 per bushel. This allowed the margin to expand two cents to $0.86 per bushel. The estimated margin is 34 percent over levels from year ago.