11.21.2025

Sausage casings bulletin, November 21, 2025

...

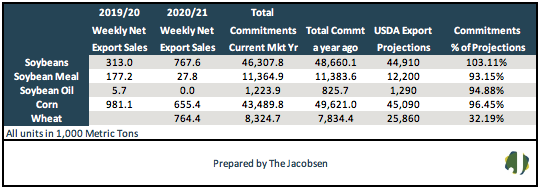

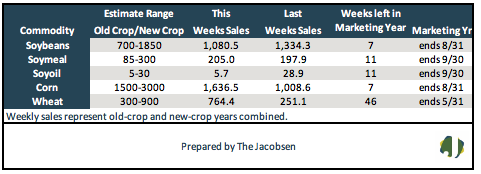

Soybean export sales for the 2019/20 marketing year of 313 thousand metric tons (TMT), were 639.2 TMT below last week’s total and 46 percent below the four-week average of 583.5 TMT. New crop sales totaled 767.6 TMT, lifting total sales to 1,080.5 TMT. Combined crop year sales were 19 percent below last week’s but within analyst estimates that ranged from 700 to 1,850 TMT. 2019/20 export commitments are 103 percent of the USDA revised forecast. Export sales are five percent under the 2018/19 crop year pace. Major purchases were reported for Egypt, Indonesia, and Pakistan.

Soybean meal sales for the 2019/20 marketing year of 177.2 TMT were 52.8 TMT over last week’s total and 54 percent above the prior four-week average of 115 TMT. New crop sales totaled 27.8 TMT, lifting total sales to 205 TMT. Combined crop year sales were four percent over last week’s report and within analyst expectations that ranged from 85 to 300 TMT. Accumulated export commitments are 93 percent of forecast and need to average 76 TMT per week to meet projections. Sales are on par with last season’s pace. Major purchases were made by Honduras, Canada, and the Mexico.

Soybean oil 2019/20 export sales of 28,900 metric tons were 26.1 TMT over last week’s volume and 195 percent above the four-week average of 9.8 TMT. There were no new crop sales, leaving total sales at 28.9 TMT. Combined season sales exceeded analyst expectations that ranged from 5 to 24 TMT. 2019/20 marketing year commitments are 99 percent of forecast and need to average 1.0 TMT per week to meet revised projections. Soybean oil sales are 50 percent over last season’s pace. Major purchases were made by the Dominican Republic, Japan, and Columbia.

Weekly corn export sales for the 2019/20 marketing year of 981.1 TMT, were 785.8 TMT over last week’s total and 185 percent above the prior four-week average. New crop sales of 655.4 TMT lifted combined season sales to 1,636.5 TMT. Combined sales were 62 percent above last week’s total but within analyst expectations that ranged from 1,500 to 3,000 TMT. Increases were reported for China, Columbia, and Peru. 2019/20 export commitments are 96 percent of the USDA forecast. Export sales trail last season’s pace by 12 percent.

Wheat export sales for the 2020/21 marketing year of 764,400 metric tons, a marketing year high, were 438.2 TMT over last week’s total and 77 percent above the prior four-week average. There weren’t any new crop sales during the week, leaving total sales at 764.4 TMT. Combined sales were 204 percent over last week’s total but within analyst expectations that ranged from 300 to 900 TMT. Export commitments are 32 percent of the 2020/21 USDA forecast and need to average 381 TMT per week to meet projections. Sales are six percent above last year’s pace. Major purchases were made by Mexico, China, and Indonesia.