11.21.2025

Sausage casings bulletin, November 21, 2025

...

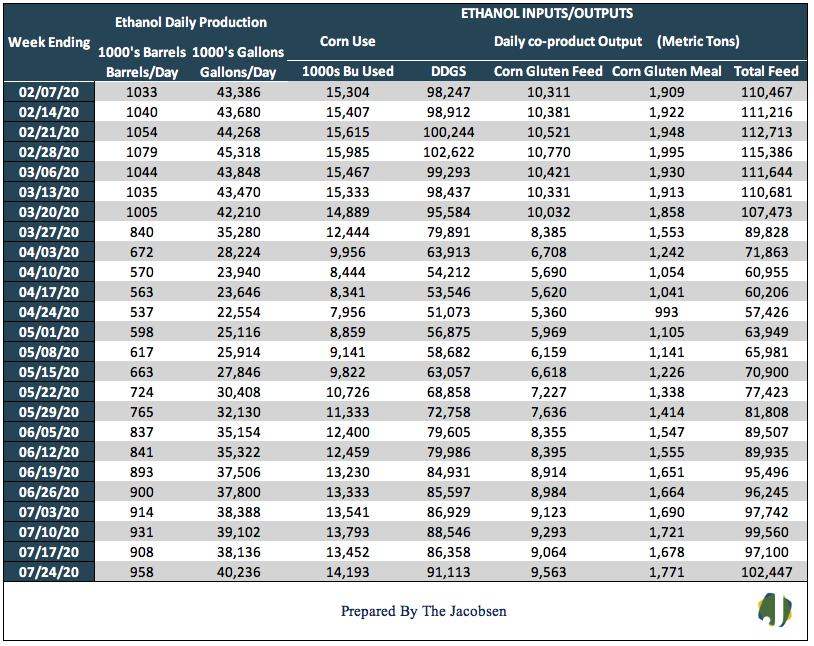

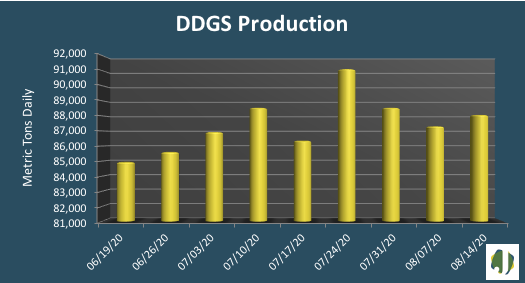

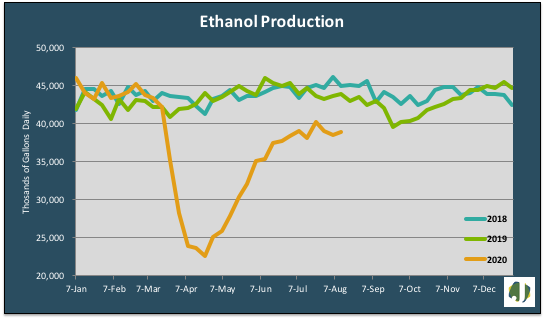

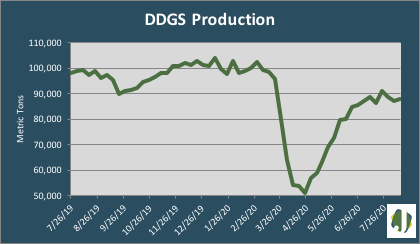

Ethanol production increased 8,000 barrels per day to a 926 million-barrel-per-day average during the week ending August 14, 2020. Ethanol and DDGS output pushed higher for the first time in three weeks as the economy struggles to keep on track. Production edged 0.9 percent higher but was 9.5 percent below levels at this time last year. DDGS output increased by 761 metric tons per day but was 10,337 MT below production from a year ago.

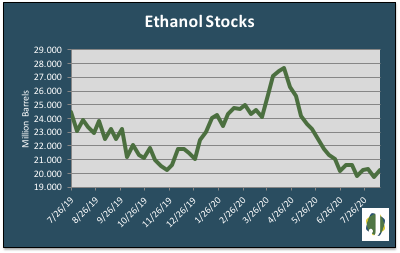

Gasoline supply fell nearly three percent from the prior week and is 10.4 percent below 2019 levels for the same weekly period. Ethanol stocks increased 2.4 percent after hitting their lowest level last week since December 30, 2016. Ethanol imports ceased after three straight weeks of landing on the West Coast. The increase in ethanol output raised corn demand by 119 thousand bushels per day. DDGS output moved with ethanol production, rising 0.9 percent for the week.

Ethanol output is averaging 887,588 b/d per week during 2020, up 1,164 barrels daily from last week but 140,950 barrels below 2019 average weekly production. The ethanol blend rate expanded to 10.7 percent. Average year to date gasoline demand is 56 million gallons per day below 2019 average demand.

Approximately 13.7 million bushels of corn were consumed daily in the production of ethanol and, as a co-product of production, 98,683 metric tons of livestock feed was produced daily. DDGS production accounted for 88,070 metric tons, with the balance comprised of 9,072 MT of corn gluten feed and 1,541 MT of corn gluten meal.

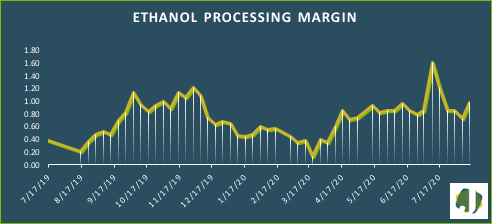

The estimated ethanol-processing margin increased sharply last week as ethanol prices moved higher. Revenue from ethanol and DDGS sales increased from $4.51 to $4.76 per bushel while the cost of corn fell a penny to $3.18 per bushel. This allowed the margin to expand 26 cents to $0.99 per bushel. The estimated margin is noticeably above levels from year ago.