11.21.2025

Sausage casings bulletin, November 21, 2025

...

Weekly Recap – Wheat Prices Advance While Corn and Soybeans Consolidate

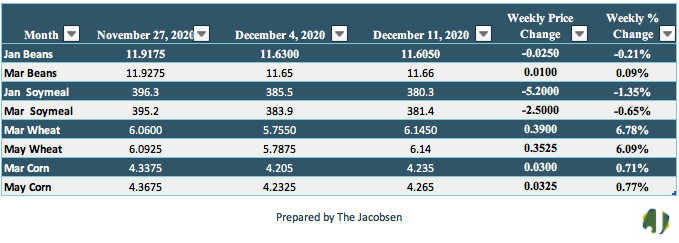

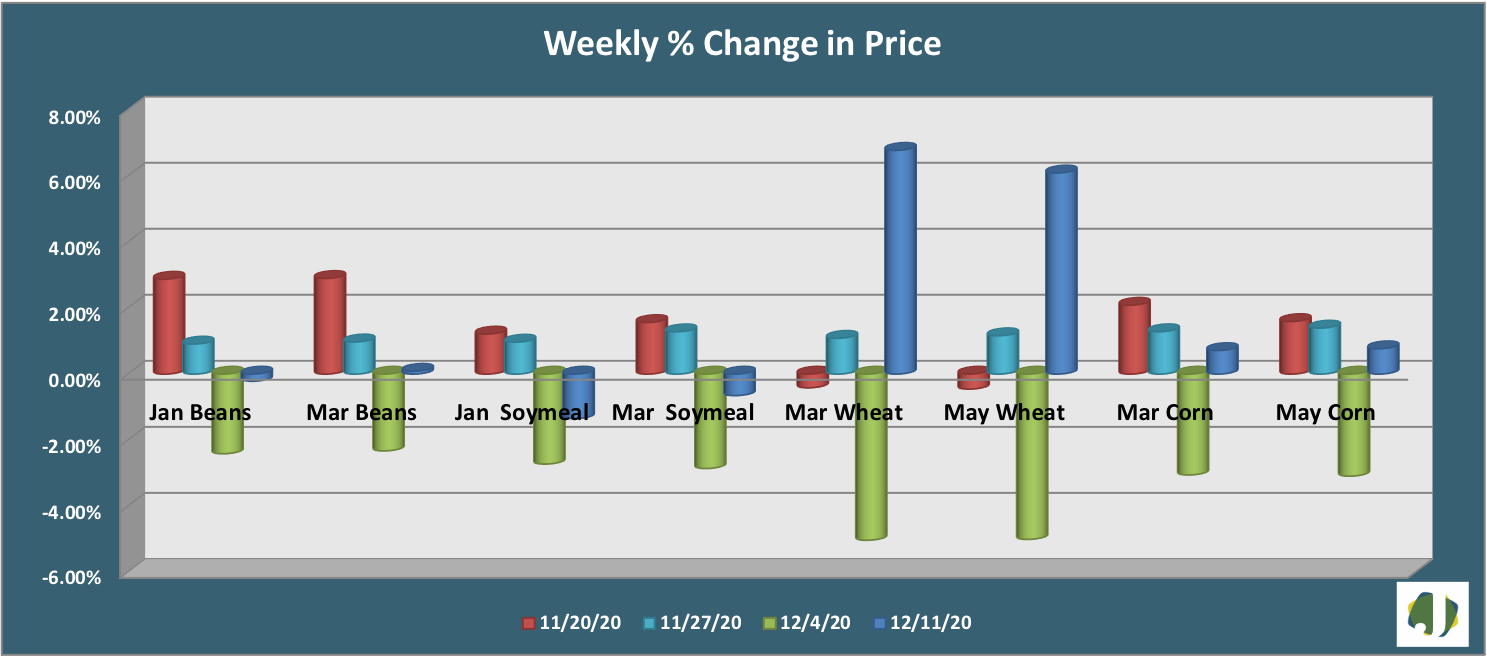

For the week ending December 11, soybean futures showed mixed results for the two front month contracts. The January future posted a fractionally lower close for the week, while the March contract pushed fractionally higher. The January contract was lower for a second consecutive week while the March contract posted a stronger weekly gain for the fifth time in six weeks. Last week was more of a consolidation week as the current week appears to have additional underlying support to start the week. Argentine grain inspectors and oilseed workers announced on Saturday they would extend their wage strike and will continue to curtail crushing activity in a key export hub that handles about 80 percent of the country’s agricultural exports. Additional support price support is seen surrounding South American weather forecasts and export demand. US Soybean exports were at the high end of expectations in last week’s report and are running 96 percent over last season’s export pace. Price support is seen at $11.61versus resistance at $12.01 for the January futures contract. Friday’s close was 13 cents per bushel above values from a month ago but 31 cents below pricing two weeks back. The latest Commitment of Traders (COT) report showed managed continued to reduce long holdings for a fourth consecutive week. Net long holdings declined five percent to 185,655 contracts, a thirteen-week low.

Soybean meal futures moved lower on a weekly basis for a second consecutive week. The January soybean meal future fell $5.20 to $380.30. Soybean meal prices are $7.50 per ton below values from a month ago and $16.00 below pricing two weeks back. Price support is seen at $374 and resistance at $391. Managed money reduced long holdings for the fifth straight week according to the Latest COT report. Net long holdings were down 11 percent to 62,642, a 12-week low.

Corn futures edged higher on a weekly basis and have increased in value over five of the past six weekly periods. Values only saw fractional increases of just under one percent on a weekly basis. Strong export prospects continue to underpin values while the latest WASDE data showed a slight tightening in corn ending stocks. Corn exports of 1.36 million metric tons were at the high end of analyst expectations and are running nearly 156 percent over last season’s export pace. Prices are currently testing support is seen at $4.21 with additional support seen at $3.99. Price resistance remains at $4.38. Ethanol production increased 1.8 percent to 991 thousand barrels per day, increasing daily DDGS output by 1,617 metric tons per day as ethanol production hit a fresh post pandemic high. Increased ethanol output coupled with reduced gasoline demand has pushed margins to a 36-week low. DDGS prices are trading $60 to $70 over their historical three-year average for this time of year and have shown a 60 percent chance of extending price gains during the month of December. Corn futures are four cents per bushel above values from a month ago but 10 cents per bushel below pricing from two weeks back. Friday’s COT report showed managed money made no major directional moves in corn holdings during the past week. Both long and short holdings increased, leaving the overall net long position unchanged at 269,583, a seven-week low.

Wheat futures moved noticeable higher, increasing in value for the first time in five weeks. Wheat prices traded up to previous resistance but could not push through. Export demand exceeded market expectations last week helping to support the move. This year’s export pace is 13 percent over last season’s. Weather continues to be a barometer for pricing. Wheat Midd values remains firm in the near-term and have been trading $25 per ton over the three-year average in recent weeks. Historically, prices have moved higher 80 percent of the time during December. Suppliers expect pricing to remain firm through December and begin to soften over Q1 of 2021. Wheat futures are 13 cents per bushel over values from a month ago and nine cents above pricing two weeks back. Price support is at $5.75 with resistance at $6.17. Managed continued to add to overall short holdings last week. Hedging activity moved to being net short 4,397 futures contracts to 5,692.